Read the latest issue of Dairy Market Drivers, a bi-weekly report from IDFA partner Ever.Ag. Dairy Market Drivers features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

Dairy Market Drivers: American Consumer Situation and Sentiment; U.S. Beef and Dairy Herd Numbers; and Nonfat Dry Milk Supplies in a Minute!

Quick Bites: U.S. Dairy and Beef Herd Report

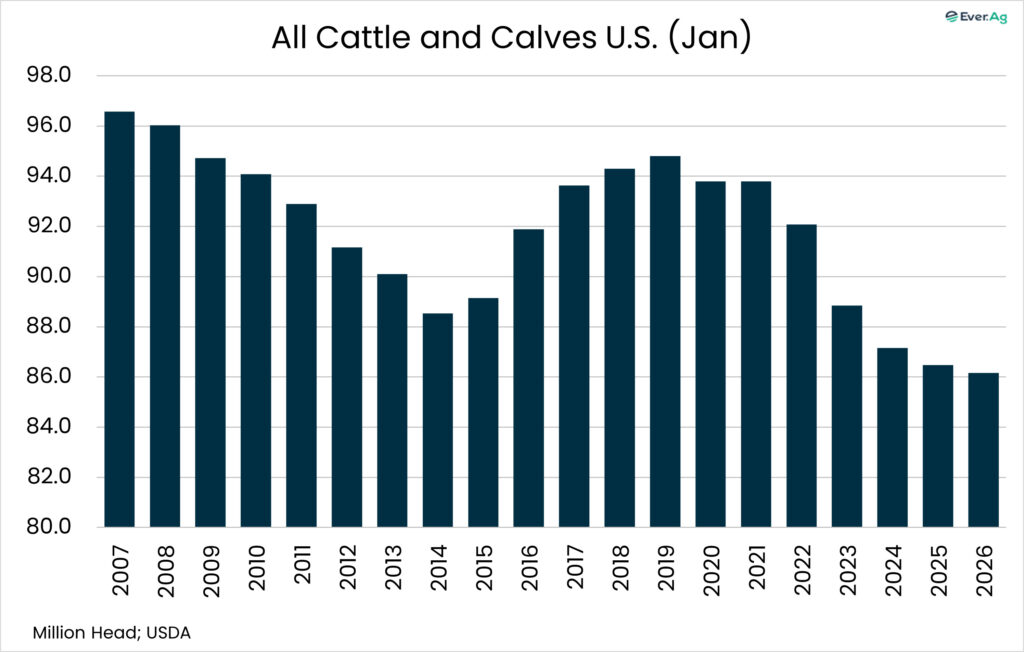

- Dairy farm margins have benefited from beef sales income, especially the past few years. Growing demand for beef and a shrinking U.S. beef herd have driven up prices and opened the door for dairy producers to garner higher prices for cull cows and dairy-beef calves.

- Rising input costs, less profitability, an aging ranch workforce and severe drought in some areas discouraged ranchers from rebuilding their herds the past few years. That trend continues, as USDA’s January Cattle report showed a slight reduction in all cattle and calves. At 86.16 million head, this is the smallest U.S. beef herd in 75 years.

- The number of beef cows and heifers that calved also dipped slightly from last year. However, the number of heifers held for beef replacement climbed slightly versus last January. If ranchers are holding onto more heifers, it could be a small but early sign of a potential herd rebuild.

- On the dairy side, milk cow numbers climbed to 9.57 million head - the highest level since 1993. Dairy replacement numbers, however, continue to decline. USDA pegged dairy heifers at 3.90 million head, the lowest level since 1978. The data confirms that dairy farmers are raising fewer heifers and are instead focusing resources on creating valuable dairy-beef animals for a faster path to income.

Today's Special

- The U.S. job market started the year strong, as U.S. employers added 130,000 positions in January, ahead of expectations for +75,000. However, the U.S. Bureau of Labor Statistics Department revised its 2025 total to +181,000 jobs, far below the previously reported +584,000 and the weakest growth since 2020.

- Consumer spending ended 2025 at a slower pace, with retail sales totaling $735.0 billion in December. That was even with November and up 2.4% year-over-year, below expectations. Grocery store spending inched up only 0.1% from November and +1.5% on the year. Restaurant spending declined by 0.1% from the month before, although spending was 4.7% higher than in 2024.

- Moving into January, inflation cooled, sliding closer to the Federal Reserve’s target rate. Prices rose 0.2% from December and +2.4% year-over-year, compared to expectations for +0.3% and +2.7% growth. The Food at Home Index rose 0.2% month-over-month and +2.9% year-over-year, while menu prices increased 0.1% and +4.0%.

- Consumer sentiment improved slightly, but it is still historically low. The University of Michigan Consumer Sentiment Index’s preliminary reading for February inched up to 57.3 from 56.4 in January. But last February, the reading was 64.7.

- Nervous consumers tend to spend less when they shop and eat out, which can negatively impact dairy demand. But promotional activity is heating up at retail ahead of Easter, and restaurants are taking advantage of less expensive cheese to feature it more prominently on their menus. So, opportunities for cash-strapped Americans to enjoy more butter and cheese could be around the corner, hopefully boosting dairy product sales.