Read the latest issue of Dairy Market Drivers, a bi-weekly report from IDFA partner Ever.Ag. Dairy Market Drivers features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

Dairy Market Drivers: Private Label Sales On the Rise; U.S. Milk Production Growth; and Super Bowl Spending in a Minute!

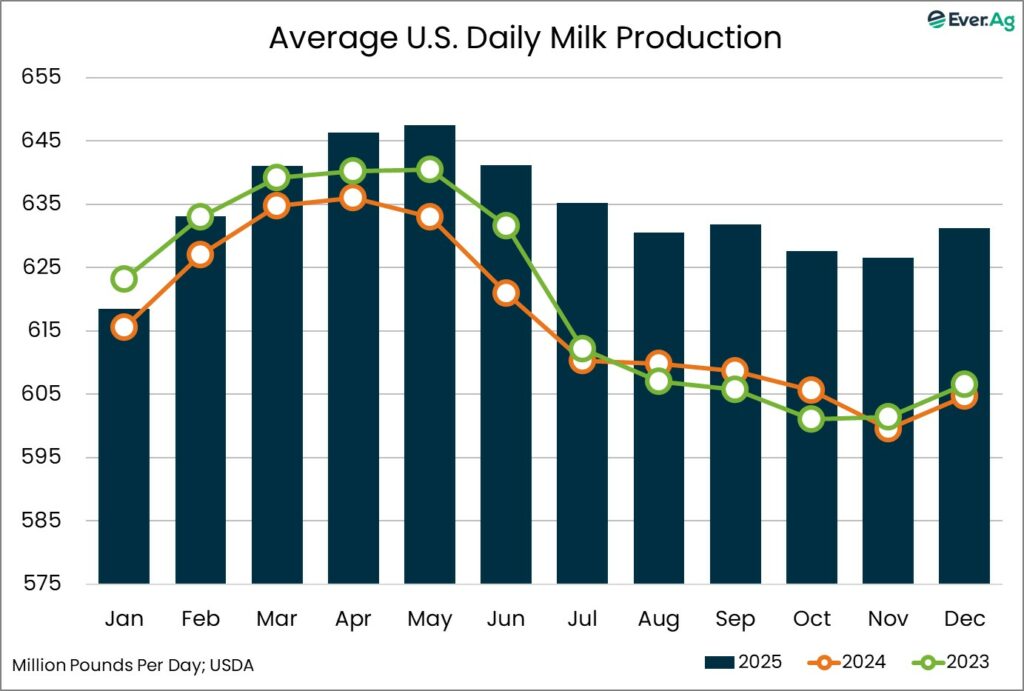

Quick Bites: Milk Output Maintains Strength

- Last year wrapped up with sizable milk production growth. December output picked up 4.4% year-over-year with growth spread across the U.S.

- In all, 2025 milk output totaled 231 billion pounds, a new annual record. Big gains in California helped lead the way as production in the Golden State recovered following 2024’s avian influenza outbreak. There was also a lot of growth in places like Kansas, South Dakota and Texas, where new processing facilities have been built.

- Today’s cows are making more milk than ever, but big gains in cow numbers also helped propel 2025’s production total. The U.S. dairy herd finished the year with 9.567 million head – up 212,000 cows compared to December 2024.

- Milk also continues to flow in other major dairy countries around the world. In the European Union, production leapt 4.7% year-over-year in November, where high pay prices and good, inexpensive feed are encouraging farmers to keep milking cows. New Zealand’s production year got off to a strong start, sending output up 2.5% in December.

- Ample milk supplies in the U.S. and around the globe are expected to keep pressure on milk and dairy commodity prices as we begin 2026.

Today's Special

- Private-label grocery sales hit a record $282.8 billion in 2025. That marked a roughly $9 billion increase over 2024, with store brands growing about three times faster than national brands, Circana data shows. This growth reflects a growing consumer focus on value.

- Refrigerated products led all private label categories in dollar growth, rising 6.1%. Beverages followed with 4.8% growth.

- According to the Private Label Manufacturers Association, natural cheese led the way in private label dollar sales at nearly $9.9 billion in 2025. Milk was third on the list, with close to $9.2 billion in sales. With over $2.4 billion in sales, butter and butter blends also made the top 20 list.

- Unit sales reinforced the shift toward store brands. Private-label volume increased by roughly 434 million units to a record 68.7 billion units while national brand unit sales declined by 0.6%. In the past five years, private label unit sales climbed more than 30%.

- As for dairy, natural cheese had nearly 3 billion in unit sales in 2025, only surpassed by bottled water. Milk represented 2.9 billion units, and yogurt sales topped 5.8 billion units last year.

- Among 20 major US retailers, Trader Joe’s and Aldi rely most heavily on private–label products, with store brands accounting for roughly 75% of sales volume. Numerator data shows newer store-brand launches from Walmart, Target and CVS ranked among the fastest-growing private-label brands by unit volume.

- This data shows a shift in how shoppers are prioritizing value over label loyalty. Even higher-income households are increasingly choosing store brands as value and quality become as important as price in purchase decisions.