Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: Quick Service Restaurant Traffic; Dairy Per Capita Consumption Data; and Key Dairy Market Fundamentals for 2026!

Quick Bites: Americans are Choosing Dairy

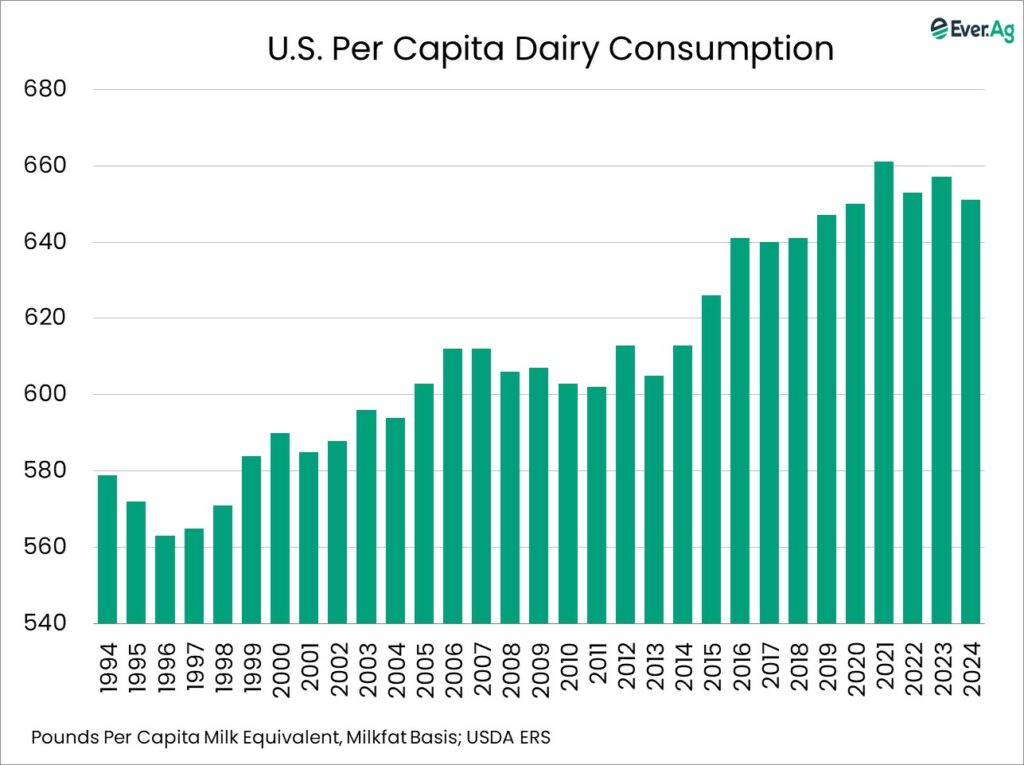

- People’s eating patterns are changing, but dairy remains a staple in the American diet. In 2024, Americans consumed 651 pounds of dairy products per person on a milk-equivalent, milkfat basis, according to USDA’s most recent data.

- Riding the wave of protein demand, yogurt and cottage cheese saw big intake leaps from the year before. Yogurt consumption rose to 14.5 pounds per person – up 6% from 2024 and 58% more than just two decades ago. Cottage cheese intake climbed 14.3% year-over-year to 2.4 pounds per person, the highest level since 2009.

- Butter consumption reached a record high 6.8 pounds per person. Following years of being villainized as an unhealthy fat, butter’s reputation turned around about 10 years ago, and intake is up more than 20% in the last decade.

- Total cheese consumption in 2024 didn’t change from the year before, holding at 41.9 pounds per person. Back when USDA began collecting this data in 1975, Americans were eating less than 20 pounds of cheese a year.

- After decades of declining intake, fluid milk consumption also stayed constant between 2023 and 2024 and stands at 127.0 pounds per person. In 1975, that number was 247 pounds per person per year.

- As for a sweet dairy treat, ice cream intake nudged up slightly to 12 pounds per person. 0.2 pounds more than in 2023. While people still like to indulge in dairy desserts, this data shows a clear trend toward dairy products that pack more of a protein punch.

Today's Special

- Restaurant traffic has not impressed in 2025, but a few limited-time offers at popular fast-food chains brought people racing in for a meal. Quick-service restaurant visits have trended higher the past few weeks and were up more than 4% year-over-year the first full week of December, according to Placer.ai data. That was the strongest weekly growth since January.

- Burger chains saw the biggest gains in traffic, and the timing aligns with two well-received promotions. In early December, Burger King introduced a SpongeBob menu that coincides with the new movie release. This menu featured items such as a Krabby Whopper and Mr. Krab’s Cheesy Bacon Tots. The restaurant reported high demand and even shortages of menu items due to the promotion’s popularity.

- And then there is – or actually, was – the “Grinch Meal” at McDonald’s. The buzz over this promotion led it to sell out in many markets in less than one week. Diners could choose McNuggets or a Big Mac for their main course, and the meal came with a side of dill pickle “Grinch Salt” fries and a pair of socks to take home.

- These promotions gave both McDonald’s and Burger King a boost to wrap up 2025. And even if it is just temporary, cheese should also benefit. Every Big Mac has two slices of cheese, and consumers can add cheese to Whoppers as well. Domestic cheese demand has been ho-hum this year, but restaurant meals are an important vehicle for cheese utilization. And let’s not forget that dairy farmers are in the beef business, too. So, market offerings that bring people to these burger restaurants are good news for the dairy industry.