Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: Gen Z Dining Spending Habits; Milk Production Update; and Inflation in a Minute!

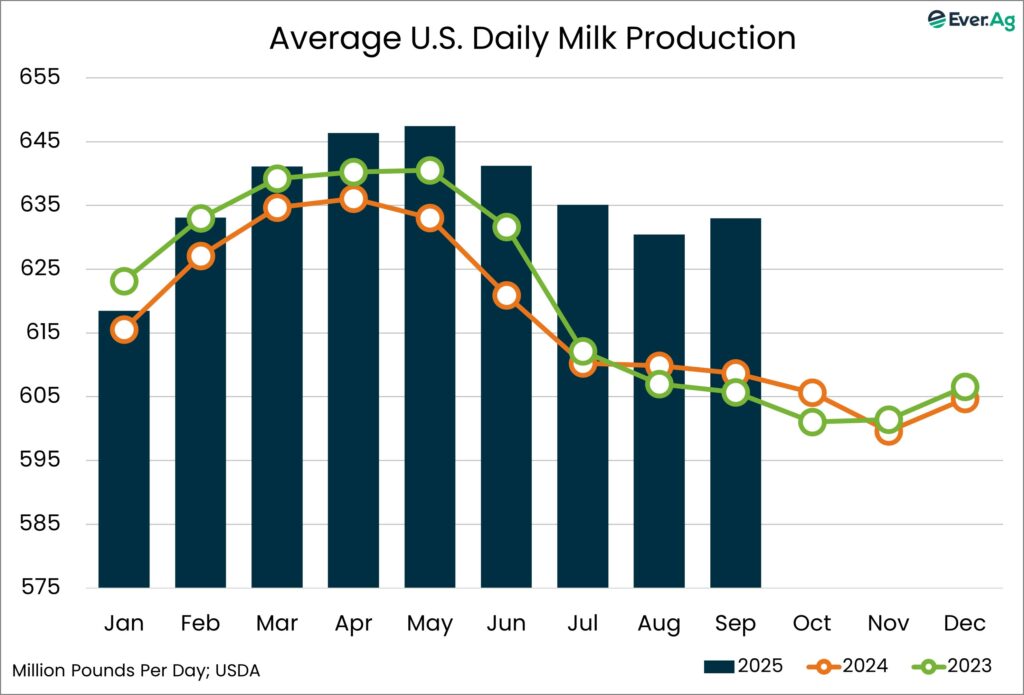

Quick Bites: Milk Production Keeps Climbing

- Strong growth has been the milk output story of 2025, and September was no exception. USDA’s delayed September Milk Production report showed a 4.0% year-over-year gain in milk output for the month. That followed 3.2% growth in August and a 3.4% increase in July.

- Production was up across the country in all major milksheds. In the Southwest, output rose 5.3%, followed by +4.5% in the Northwest. The Northeast saw 4.0% growth, with the Midwest coming in at +3.5%. California production was +2.4% higher compared to last September. The only state with major reductions in milk and cows was Washington, down 8.5% in milk output and -8.9% in herd size.

- Cow numbers also surged by 40,000 head. August cow numbers were revised upward by 42,000 head as well, marking the two largest monthly increases since 2008. Year-over-year, the dairy herd is up by 228,000 head. That’s the biggest gain since monthly data collection began in 1998.

- The U.S. dairy herd now sits at 9.581 million head, the biggest herd in more than 30 years.Although sinking milk prices will undoubtedly put downward pressure on farm margins, plentiful feed and additional income from beef sales should provide positive support to dairy farms in the months ahead. That may be enough to keep the U.S. on this milk growth trajectory as we move toward 2026.

Today's Special

- Many young adults are feeling the squeeze of higher prices, and restaurants are feeling the fallout. Customers age 25 to 35 once made up one-quarter of Chipotle’s sales, but a third straight quarter of declining traffic – down 0.8% in Q3 – illustrates how younger customers are pulling back from dining out. The company’s CFO explained that Millennials and Gen Z consumers aren’t choosing competitors; instead, they are shifting toward grocery shopping and home-prepared meals, signaling that financial pressures, rather than changes in taste, are driving behavior.

- Personal financial pressures are mounting rapidly, affecting everyday spending decisions. Student loan repayments and rising unemployment – now 10.5% for 16- to 24-year-olds, nearly triple that of older generations – are constraining budgets for many young consumers. In addition, wages for young workers aren’t keeping pace. A JPMorgan Institute report showed that workers between the ages of 25 and 29 experienced the weakest income growth over the past decade. With these financial hurdles, dining out has become an expense many simply cannot afford.

- When they do dine out, many young adults are changing how they approach restaurant meals. To stretch their dollars, they are splitting appetizers, ordering from kids’ menus, opting for lower-cost items and avoiding premium add-ons – if they eat out at all. A Redfin survey found that 40% of Gen Z and millennial renters are dining out less to afford rent, while more than 20% are skipping meals entirely to save money.

- These consumer shifts have potential knock-on effects for dairy demand, cheese, butter, sour cream, and other items figure prominently in many restaurant meals. Fewer visits and smaller order sizes reduce demand for dairy-heavy items like lattes, cheese-topped entrees and desserts. Perhaps dairy staples like milk, cheese and butter will benefit from an uptick in grocery purchases and more meals at home, but overall, recent dairy demand at retail has been uninspiring. Right now, young adults appear focused on value when it comes to food – whether they are eating at home or at a restaurant.