Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: Beverage Trends; Argentine Soybean and Beef Exports; and Consumer Spending Across Income Levels in a Minute!

Quick Bites: Milk is Still in the Mix

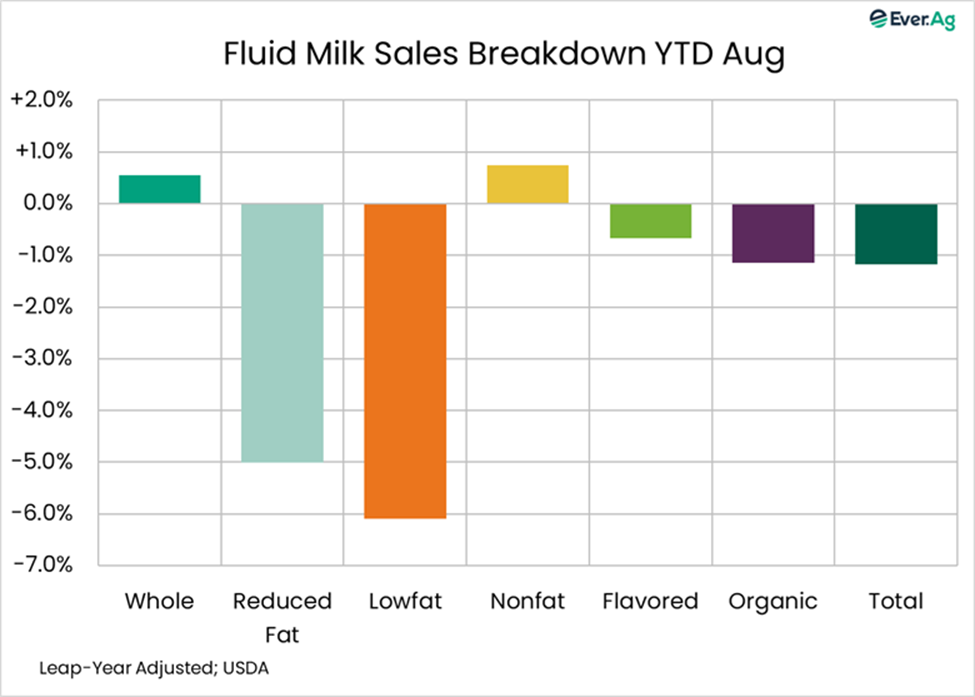

- In 2024, U.S. fluid milk sales topped year-prior levels for the first time in more than a decade. A repeat this year looks increasingly difficult.

- In August, total fluid milk sales volume (conventional plus organic) fell 4.1% from last year to 3.44 billion pounds, the largest year-over-year pullback in 18 months, although whole milk and nonfat milk sales were up slightly. Year-to-date, sales are down 1.2%, compared with a 0.9% increase a year earlier. That is about 327 million pounds less of fluid milk sales each week.

- What about the broader beverage category? Coca-Cola recently released its Q3 performance, which topped expectations with demand for its products still soft but improving. The company’s water, sports drinks, coffee and tea segments were up 3% from last quarter. On the other hand, juice, value-added dairy and plant-based beverages dipped 3%. Company executives noted that low-income customers are buying fewer of their products.

Today's Special

- Argentina has been front and center of many recent agriculture conversations. First, it was all about soybeans. China decided to push pause on U.S. soybean imports and turned to South America to fill that gap. When Argentina suspended tariffs on grains and their derivatives to increase export sales, Chinese buyers swooped in, purchasing Argentine soybeans to cover short-term needs. That left U.S. soybeans on the sidelines in September.

- This month, the focus turned to Argentine beef. U.S retail beef prices continue to hit record highs month after month, with ground beef averaging $6.32 per pound in September. To ease prices, President Donald Trump announced plans to import more beef from Argentina, a move met with skepticism and concern from many with ties to the U.S. beef industry.

- Argentina is a player in the global beef market as the sixth-largest beef-producing country and the fifth-largest exporter. Most Argentine beef exports go to China, followed by Israel, the European Union and the U.S. But domestic consumption utilizes nearly three-fourths of the country’s beef production.

- Will more imports from Argentina really move the needle on U.S. prices? According to Oklahoma State University’s Derrell Peel, Argentina’s beef production is about 27% of total U.S. beef production. Argentine beef imports into the U.S. have been growing, but they only account for 2.1% of beef imports so far in 2025. Even if the U.S. were to take all of Argentina’s projected beef exports for 2025 ─ which is not likely ─ it would represent less than 2.5% of the total U.S. beef supply. Most Argentine beef imports are used for ground beef production, but even increased imports from Argentina are not likely to moderate prices much, if at all.

- Sales of cull cows and dairy-beef calves have been an important income source for dairy producers in 2025. Will more beef imports cut into those profits? It seems unlikely that beef from Argentina will make a big dent in supply and demand dynamics, and the drivers behind record-high beef prices persist. Years of drought and short feed supplies led farmers to reduce beef cattle numbers, resulting in the smallest U.S. beef herd seen in decades. Meanwhile, demand for protein is on the rise, and despite escalating prices, people still appear willing to pay for beef as a protein source.