Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

Dairy Market Drivers: Transportation Update; Beef Demand and Price Trends; and Groceries in a Minute!

Quick Bites: Consumers Stick with Beef

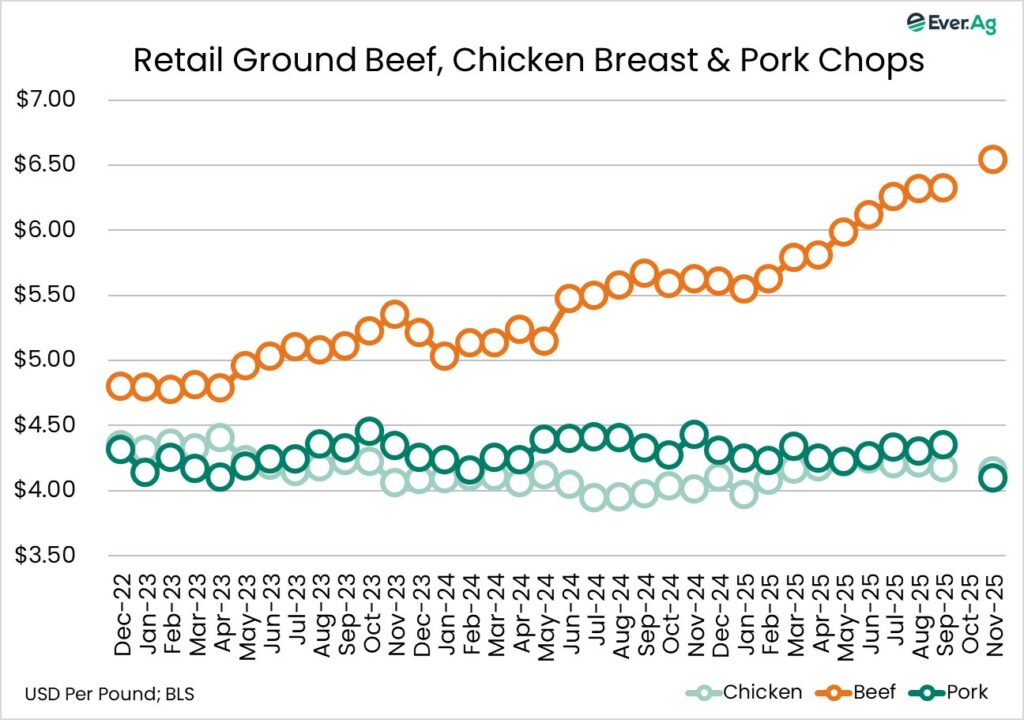

- Demand remains impressive despite beef’s elevated price tag. According to the Bureau of Labor Statistics, ground beef prices hit $6.54 per pound in November, up 16% year-over-year to reach an all-time high. During that same month, Circana data showed fresh beef volume sales rising 4.1% year-over-year, beef’s best performance since May.

- Meanwhile, prices for chicken and pork sit more than $2.00 per pound below beef. But while volume sales were also up 4.5% for chicken and +0.7% for pork in November, people are not making the major shift to other meats that we may expect when beef prices are this much higher.

- Consumers are still leaning toward beef as their preferred meat protein choice. Americans also like the taste of beef and know how to cook it.

- Meanwhile, the momentum of plant-based meat continues to fade. Beyond Meat’s slipping sales – which dropped 13% on the year and are down 34% from 2021 – reflect consumers’ preference for traditional meat with simpler ingredient labels and better flavor.

- Stronger beef demand has meaningful market implications for dairy. As milk prices fall heading into 2026, the income from higher-priced dairy culls and beef-on-dairy calves has become a valuable revenue stream for today’s dairy farms.

Today's Special

- The ability to move milk and dairy products across the country and around the globe is vital to the dairy industry. Tariffs were one of the factors that shaped transportation and trade of dairy products and much more in 2025.

- Unpredictability in the tariff schedule during the first half of 2025 caused volatility in cargo volume at U.S. shipping ports. Some of America’s busiest ports handled a lot of volume early in the year. Imports nosedived in May after steep levies were placed on China, but volume returned in the Summer and Fall after some tariffs were paused.

- The health of the trucking industry is tied to the volume of imports. The Cass Freight Index is a reliable indicator of shipping activity and economic trends. October’s reading was down nearly 8.0% year-over-year, following the cargo volume drop. Last year’s annual index is on pace for another negative year following declines of -5.5% in 2023 and -4.1% in 2024.

- As for hauling milk, Ever.Ag reported spot tanker rates for 2025 through November at $4.92 per mile. That was a dime less per mile versus the same 11 months in 2024.

- Diesel prices eased slightly in 2025, helping lower trucking costs. Diesel averaged $3.66 per gallon in 2025, 10 cents less than in 2024. The year closed with a diesel price of $3.54 per gallon, which sat below the five-year average of $3.64 per gallon.

- Even as tariffs impacted consumer purchases, railroad traffic saw an uptick in 2025. U.S. railroads reported that carload volume was up 1.5% year-over-year through December 27, and intermodal container volume was also 1.5% higher.

- Consumers depend on our ability to move dairy products from milk sheds to regions that are milk deficient, and roughly 18% of U.S. milk production leaves the country as exports. Reliable, affordable transportation remains a key factor in the dairy industry’s success.