Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: Consumer Holiday Spending Outlook; High-Protein Whey; and EU Milk Production in a Minute!

Quick Bites: High Protein Whey Shines

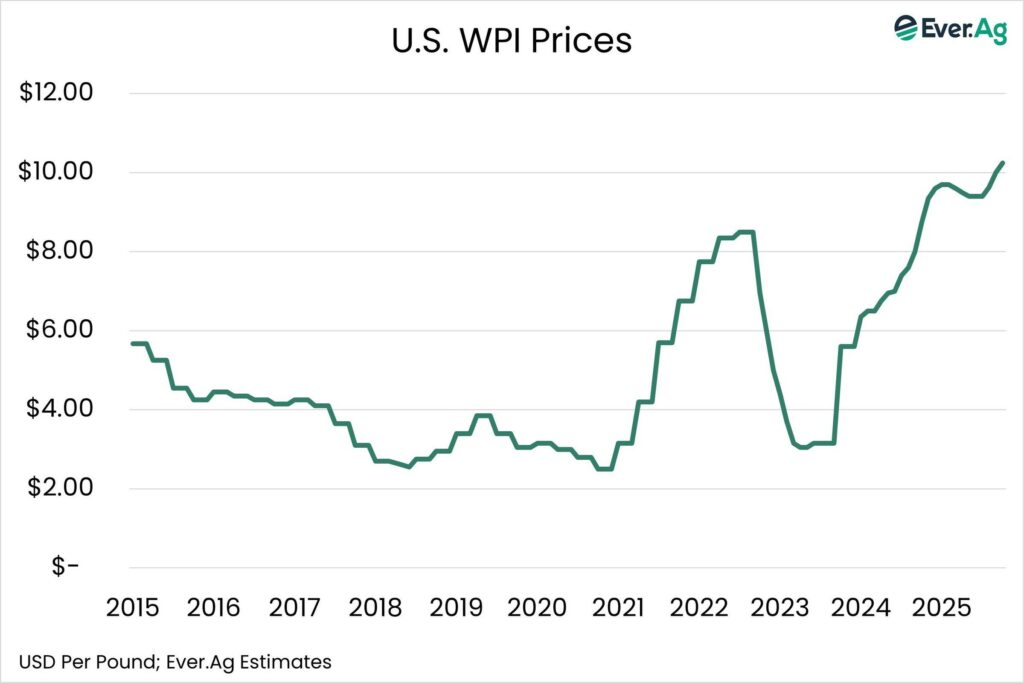

- High protein whey demand has been skyrocketing, bringing prices to new heights. High protein whey continues to outperform other dairy markets, and anecdotal reports indicate that whey protein isolate (WPI) recently topped $10 per pound.

- Growing demand for high protein whey has pulled production away from sweet dry whey, tightening those inventories. At the same time, limited capacity and strong demand for high-protein products are limiting whey protein concentrate and whey protein isolate availability.

- Clear whey is making high-protein options even more versatile. Derived from whey protein isolate and further processed to boost protein while reducing fat and carbs, it has a light, juice-like flavor and appearance and dissolves easily in water. It’s being used in ready-to-drink beverages that appeal to consumers seeking high protein without the heaviness of traditional shakes.

- Protein is popping up in everything these days. Starbucks recently added high-protein lattes that can boast more than 40 grams of protein with cold foam – despite a $9 price tag, consumers seem to be buying in. PepsiCo is the latest to join the trend, unveiling new high-protein beverages using whey, including Propel flavored waters. Mainstream brands are betting big on high-protein innovation, further supporting demand for whey and its derivatives.

Today's Special

- People will soon be trading in their pumpkin spice lattes for candy canes and mugs of hot chocolate. Holiday season preparations often include shoppers filling their carts – in stores and virtually – with gifts to spread cheer. But will inflation, tariffs and economic uncertainty put a damper on this year’s holiday spending?

- Consumers are already bracing themselves for the sticker shock – more than 80% of shoppers anticipate higher prices this year, according to Circana data. Nearly one-third of shoppers said they will buy fewer gifts, and 34% will take advantage of more deals. Overall, individuals plan to spend $796 on their holiday shopping, up 3% from last year.

- Rather than wait, people seem eager to start shopping earlier this year despite higher prices. Almost half of shoppers plan to buy some gifts before Thanksgiving, while 19% expect to start shopping on Black Friday. Only 19% of shoppers plan to hold off until December to start buying gifts, the lowest level in recent years.

- Almost two-thirds of shoppers noted that grocery costs will impact their holiday spending. With tighter budgets, people appear more focused on practical gifts, like housewares and sporting goods, with intentions to spend less on more expensive items like electronics.

- Retailers are reacting with plans to hire fewer holiday workers. Job placement firm Challenger, Gray & Christmas estimates holiday hiring will probably dip below 500,000 positions for 2025. That would be the smallest seasonal gain total in more than a decade and well below last year’s 543,000 jobs.

- What will the holidays bring to the dairy aisle? Retailers often discount butter and other dairy products ahead of seasonal baking activity. With an abundance of butterfat coming off the farm and plenty of butter in inventory, there are expectations for potentially steep discounts this year. This could be good and bad news for dairy. While sales now would move butter off the shelf, purchases could dip in early 2026 if people stock up when the price is right.