Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: Changing Consumer Food Trends; California's Milk Output; and Halloween Spending in a Minute!

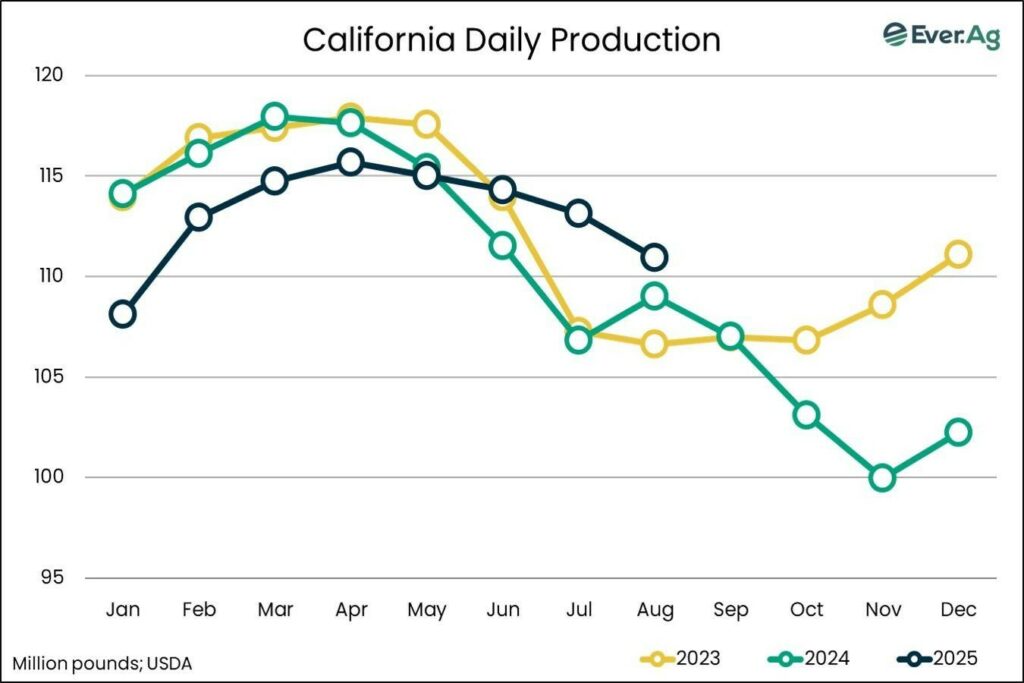

Quick Bites: California Milk Production on the Rise

- U.S. milk production is on a roll, with August output up 3.2% compared to the same month last year. That followed a 4.2% jump in July – the biggest year-over-year gain since 2021. Cow numbers also leapt 10,000 head from July to August, leading to the largest U.S. dairy herd in more than 30 years.

- Strong growth continues in states like Idaho, Kansas, South Dakota and Texas, where new cheese processing capacity is ramping up. But another state has been surpassing expectations and helping move the needle as well: California.

- California milk production soared 5.9% from June to July. At a time of year when production in the Golden State is usually subdued by hot weather, a mild summer kept cows milking at higher levels.

- August output was up another 1.7% versus strong performance in August 2024. Herds in California took a production hit a few months later because of highly pathogenic avian influenza. So, the current milk production growth is not just a rebound from disease impacts.

- As the nation’s leader in milk production and cow numbers, what happens in California matters to overall U.S. production. If each of the state’s 1.72 million cows improves output by just one pound per day, that’s more than 50 million pounds of milk for the month – equivalent to a quarter percent of the nation’s monthly production. And every 1% of milk production growth in California boosts U.S. output by 0.2%.

Today's Special

- Inflation is reshaping consumer spending. Higher menu prices and stubborn grocery inflation have squeezed Americans’ incomes, pushing some households to prioritize value over convenience. Many are cutting back on restaurant lunches, turning instead to at-home meals to control costs while still meeting nutritional needs.

- Restaurant sales growth is slowing. Technomic forecasts sales among the top 1,500 restaurant chains will rise just 2.8% in 2025, down from 3.1% in 2024 and well under the pre-2025 five-year average of 5.6%. Softer performance expected at varied locations is pushing some restaurants to experiment with ways to meet consumers in the middle.

- One approach gaining traction is shrinking meal sizes. Olive Garden is piloting a “light” menu in Madison, Wisconsin, featuring smaller versions of seven popular entrees. A light cheese ravioli costs $12.49 compared to $17.29 for the full portion – a 28% savings for diners. The option delivers a 41% calorie reduction and, by extension, lowers ingredient needs. This value-driven approach may help lift traffic counts, but it also means reduced demand for staples like cheese that are central to many restaurant meals.

- At the same time, more consumers are shifting their spending to grocery stores. Rather than going out for lunch, shoppers are increasingly stopping at grocers midday, driven by rising restaurant prices and a growing preference for healthier, home-prepared meals. Visits between 11 a.m. and 2 p.m. have risen to 26.3% for fresh-format grocers and 22.6% for traditional grocers during a time of day once spent picking up fast food.

- Packaged foods are also benefiting from a consumer shift to tighten food spending. Hamburger Helper sales are on the rise as more families use their grocery-store lunch stops to stock up on quick, budget-friendly options. Inflation has pushed shoppers to rediscover economical, shelf-stable items that stretch protein and pantry staples further. Still, with ground beef prices up 13% this past year to $6.63 per pound, these meals aren’t as affordable as they once were.