Lately, IDFA has spent a great deal of time advocating for the passage of USMCA and a trade deal with China. These important efforts are crucial for ensuring a prosperous future for U.S. dairy exports. However, IDFA also works hard to promote trade around the world that would expand market access for U.S. dairy exporters.

U.S.-Japan Trade Discussion

Dairy allies joined together in sending a letter to U.S. Trade Representative Robert Lighthizer and U.S. Department of Agriculture Secretary Sonny Perdue. The letter urges these leaders to seize an opportunity to negotiate a much-needed trade deal with Japan that will bring significant benefits to the dairy industry.

The letter explains, “Given that Japan is an established market with a growing demand for dairy products, the successful negotiation of a robust trade agreement with Japan will bring a boost to the economic health of the U.S. dairy industry and set our industry up on a path to compete effectively there moving forward. Securing robust dairy export opportunities with this overseas market will be critical to restoring confidence for our dairy farmers and processors across the country.”

Lighthizer is scheduled to meet with Japanese government officials this week to advance discussions about a potential trade agreement between the United States and Japan ahead of this weekend’s meeting of the G-7 in France. President Trump and Japanese Prime Minister Shinzo Abe are expected to discuss a deal, but the terms of any agreement are unclear.

As IDFA President and CEO Michael Dykes pointed out recently to Feedstuffs, a deal with Japan has considerable upside if it creates improved market access and a level playing field for U.S. dairy. However, if nothing happens and another potential trade deal falls by the wayside, U.S. dairy will lose access to an important market in Japan and will see its market share diminished. As Feedstuffs writes:

Dykes added that he’s optimistic that an agriculture-only deal could be reached with Japan yet this fall. If accomplished in this fashion, it would not require congressional approval. He said he believes Japan prefers U.S. dairy products, but with the tariff rate reductions anticipated with CPTPP countries as well as the EU, it may be too expensive for Japan to continue buying U.S. dairy products.

The Japan-EU agreement and CPTPP have allowed the EU, New Zealand and Australia to position themselves to seize sales from the U.S. dairy industry. Swift negotiation of a trade deal with Japan that builds on the best components of the Japan-EU agreement and CPTPP is urgently necessary for America’s dairy farmers and processors.

With per-capita consumption of dairy products in Japan increasing at 4% a year and domestic production unable to keep pace, the U.S. dairy industry stands ready to meet this demand with high-quality U.S. products. The United States exported $270 million in dairy products to Japan in 2018, making it our fifth largest overseas market with room for further growth. For instance, with a level playing field, the United States could roughly triple our cheese exports to that market over a decade. That’s particularly important because Japan is the second largest net importer of cheese in the world, importing nearly $1.3 billion in cheese in 2018.

European Union-Indonesia Trade Spat

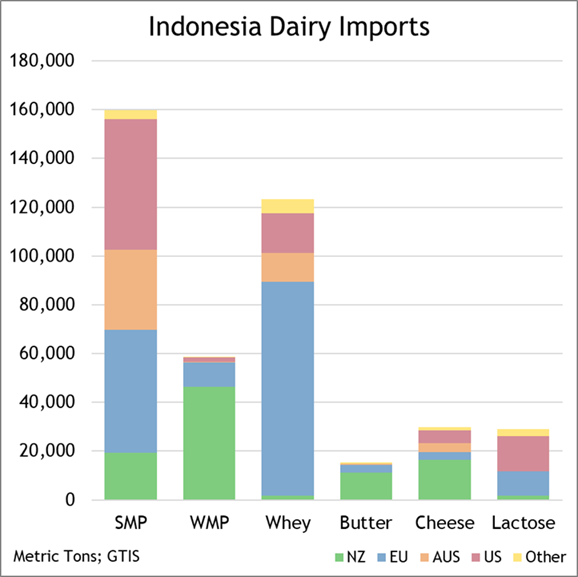

Looking at Southeast Asia, a trade war is brewing between the European Union (EU) and Indonesia that may indirectly benefit U.S. dairy. After an extensive investigation, the EU recently found that Indonesian biodiesel producers are benefitting from government subsidies. The EU has imposed tariffs ranging from 8-18 percent on a provisional basis on imports of biodiesel from Indonesia. In response, Indonesia plans to retaliate with tariffs of 20-25 percent, up from 5 percent, on EU dairy products.

The United States currently faces a 5 percent tariff on dairy products to Indonesia. New Zealand and Australia benefit from low or zero tariffs on dairy products due to preferential trade agreements with Indonesia. In 2018, the U.S. sent nearly $166 million in dairy products to Indonesia, including more than $104 million of skim milk powder, and $40 million of cheese and whey.

IDFA will continue to work with federal officials and members of Congress to expand opportunities for dairy in trade agreements and seek more market access for dairy products abroad.

For more information, contact Beth Hughes, IDFA senior director of international affairs.