Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: Online Shopping Trends; Pizza Sales and Prices Update; and Holiday Baking in a Minute!

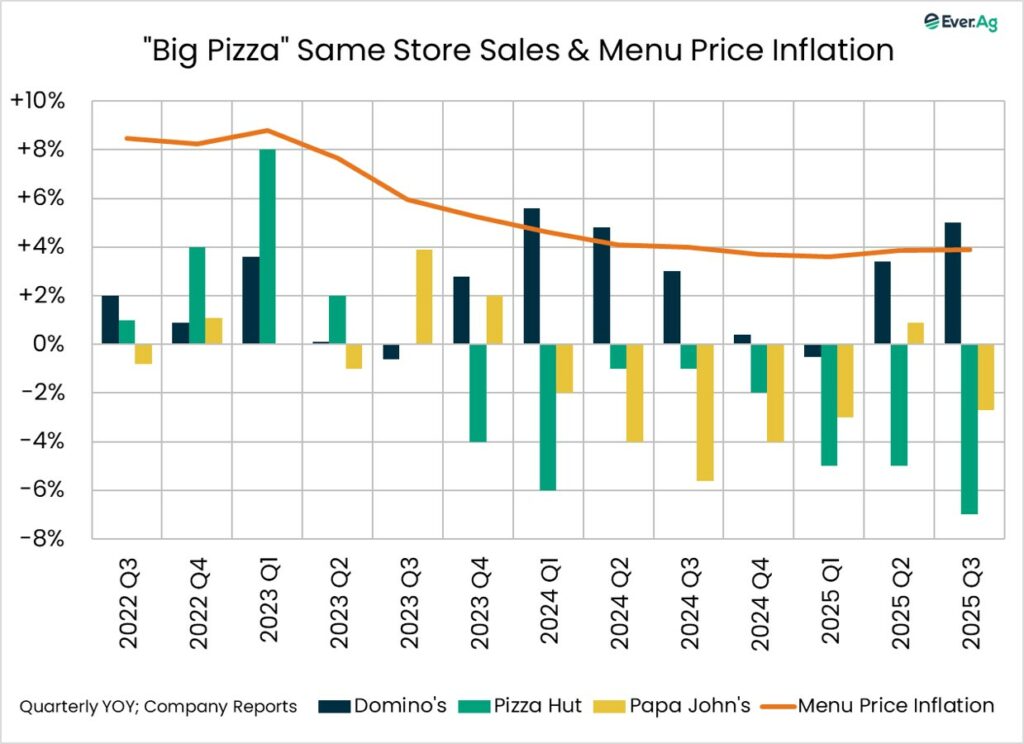

Quick Bites: Pizza Places Face Headwinds

- Pizza has long been the perfect meal to celebrate a team win, catch a quick dinner or feed a family affordably. But recently, pizza restaurants are fighting headwinds that cut into sales.

- During the COVID-19 pandemic, pizza chains were well-positioned to feed people sheltering at home because many already had established delivery options. With the emergence of third-party ordering and delivery apps like Door Dash, pizza places now face tough competition.

- People’s diets are also changing. A focus on nutrient-dense foods has some consumers reaching for healthier options. And for individuals utilizing GLP-1 weight loss medications, a cheesy slice of pizza is a lot harder to digest.

- Consumer spending has been constrained by inflation concerns, and rising prices hit the pizza market, too. A large cheese pizza now averages $17, according to the online ordering platform Slice.

- Most major pizza chains are feeling this impact. The outlier was Domino’s, with Q3 performance the best it has been since Q1 2024 on the back of a new stuffed crust offering and a “$9.99 any pizza, any topping” deal. But at the same time, Pizza Hut and Papa John’s saw slumping sales, and Papa John’s executives said customers were trading down from large to medium pizzas and adding fewer toppings.

- Smaller pizza joints are seeing similar trends. In a New York Times article, several pizza restaurants pointed to changing ordering habits, like not buying sides or adding drinks to the meal. Other customers are choosing pick up instead of delivery to shave off costs. Americans still love their pizza – and it’s an important vehicle for cheese consumption – but restaurants likely need to adapt to make sales in the current environment.

Today's Special

- The start of this year’s holiday shopping period showed a clear acceleration in online consumer behavior activity. Adobe Analytics reported that U.S. shoppers spent $11.8 billion online on Black Friday. They spent another $14.2 billion on Cyber Monday, setting a new record for the largest online shopping day in U.S. history. Growth was steady across the full week as consumers responded to earlier promotions and spread out purchases rather than concentrating them for a single day. Mobile shopping crossed an important threshold as well, accounting for more than half of online orders.

- Consumers also leaned into value. Many waited for deeper discounts before building larger baskets, and several major categories saw price drops of 20-30%, especially toys, electronics and small appliances. Apparel and beauty followed the same pattern, helped by strong promotions across most major retailers.

- Online grocery shopping also follows this trend. Brick Meets Click estimates that U.S. online grocery sales grew about 5.0% on the year, supported by heavier use of pickup for last-minute holiday needs and steady adoption among younger households who already shop primarily on mobile. Convenience, fast comparisons and the ability to avoid extra store trips all play a role.

- Retailers saw stronger digital demand for holiday-focused dairy items – cream, butter, cheese, whipping products and baking ingredients – as shoppers bundled them into broader online orders rather than making special in-store runs. According to Adobe Analytics, many households built mixed baskets that combined gifts, pantry items and refrigerated goods in a single transaction, a change that is becoming more common each year.

- Online shopping is no longer just a parallel option for consumers. It shapes promotional timing and what people order. And when it comes to the basics, it’s how many consumers plan their grocery needs from week to week.