Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: High Restaurant Prices Spur More Home Cooking; Cooling Labor Market Could Freeze Interest Rates; and Global Milk Production in a Minute!

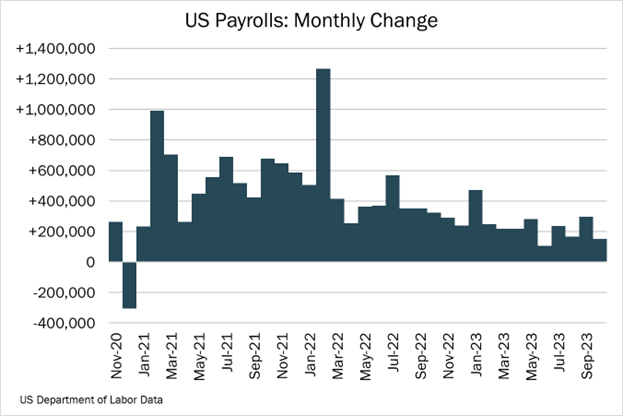

Quick Bites: Cooling Labor Market Could Freeze Interest Rates

- Late Autumn cooling coincided with a chillier U.S. labor market as the October Employment Situation report showed payrolls expanding by 150,000 jobs. That’s a sharp decline from +297,000 in September and well below expectations for +180,000.

- An uptick in the unemployment rate also points to weakness, with the measure rising to 3.9%, the highest level since January 2022. And wage pressures eased further in October as the average hourly pay increased 0.2% from September and 4.1% versus 2022, marking the lowest year-over-year gain since June 2021.

- While a potentially softening job market brings discouraging news to workers, it conversely serves as a welcome sign for the Federal Reserve, which froze interest rate hikes at its second consecutive meeting in November.

Today's Special

- As prices continue to increase, 91% of consumers are adapting their food spending habits to navigate tighter budgets, per data from Dayton. One way shoppers are containing their food spending: more home cooking, with 31% of consumers preparing meals at home more often and 20% buying more groceries. In return, the average weekly grocery bill per household is 4.6% higher than it was a year ago at $155 per week.

- The digital marketplace is also becoming more popular as shoppers are switching to virtual carts. In October, online grocery store sales surged to $11 billion, marking a 6.8% increase month-over-month. Persistent inflation was the biggest factor as research from Oracle reveals 75% of sticker-shocked consumers are comparing online and in-store grocery prices to find the best deals. And the trend is here to stay as forecasts project online grocery sales to reach $366.1 billion by 2027.

- Consumers are also turning to online aisles for a more convenient shopping experience. According to Oracle, nearly 30% of shoppers purchase groceries online for the curbside delivery and in-store pickup options.

- But many shoppers remain faithful to traditional brick-and-mortar stores, which currently account for 85% of U.S. grocery sales. And budget-friendly retailers continue to be consumer’s top choice. Walmart’s fourth-quarter financial performance exceeded expectations as the company’s same-store sales jumped 4.9% year-over-year, with groceries being the most popular product category. But the retailer provided a cautious outlook for the months ahead as elevated food prices weighed on consumer spending in October.