Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: Changes in the U.S. Job Market; Dollar Store Consumer Shopping Trends; and Independence Day Spending in a Minute!

Quick Bites: Consumers Love Discount Stores

- Almost everyone likes to find a good deal, and that desire is leading more people to discount stores, regardless of income level. Data gathered from Morning Consult revealed that 48% of households earning over $100,000 annually considered shopping at discount retailers in April, a 5% rise from the three-year average of 43%.

- Saving a few dollars is likely one reason for this shift, but so is the desire for guilt-free shopping. According to one analyst, the “cheap and cheerful items” available at these stores are resonating with consumers across income levels.

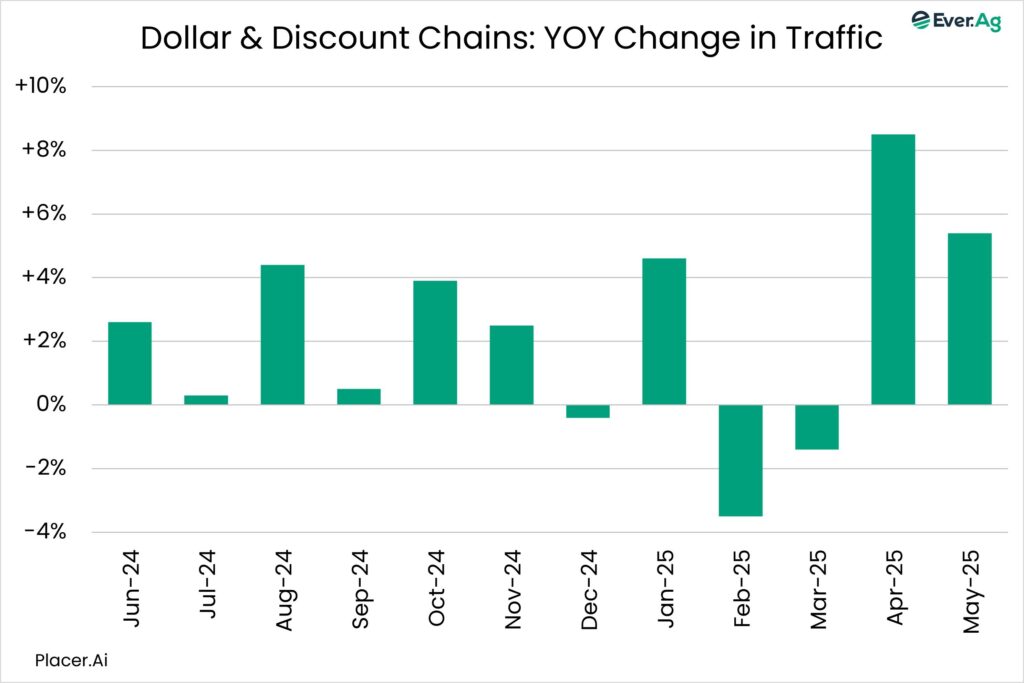

- Foot traffic data supports this trend for stores such as Dollar General, Dollar Tree, Family Dollar and Five Below. Placer.ai data showed foot traffic at these discount retailers rose by an average of 2.7% year-over-year through May 2025. In contrast, superstore visits declined by 0.8% over the same period.

- People are also choosing these discount stores for food purchases. “Consumables” now make up 82% of Dollar General’s sales, up from 78% five years ago, according to the company’s Q4 2024 earnings call. This shift reflects growing demand for affordable grocery options and makes dollar stores important players in the food retail space.

Today's Special

- The U.S. job market remains stable, but its post-pandemic momentum has eased. In May, the Bureau of Labor Statistics (BLS) reported that the unemployment rate held at 4.2%, up from 4.0% in May 2024. This signals a slight cooling in labor demand over the past year.

- Employers added 139,000 jobs in May, outpacing expectations of 129,000. In addition to these stronger-than-expected job gains cited by the BLS in the Job Openings & Labor Turnover Survey (JOLTS) report, there were 7.39 million open positions in April, a jump from 7.20 million positions in March and above April expectations of 7.10 million.

- According to ERS, agriculture and its related industries support approximately 22.1 million jobs, accounting for 10.4% of total U.S. employment as recently as 2022. Jobs in agriculture range from hands-on roles like equipment operators and farm laborers to specialized positions in agronomy, animal care and food science. Dairy operations average just over five employees each, IBISWorld reported in April, and the numbers of people employed on U.S. dairy farms grew 4.1% between 2019 and 2024.

- Some caution flags are waving. The BLS revised April job growth to +147,000 from +177,000 and full-time employment dropped by 623,000 in May. In addition, the labor participation rate dipped to 62.4% — matching its lowest level since late 2022. Initial jobless claims are also rising, with recent filings hitting their highest point since October.

- Wage growth is staying ahead of inflation. The average U.S. worker earned $36.24 per hour in May, up 0.4% on the month and 3.9% year-over-year. That annual rise in wages gives workers a boost in real earnings, making it easier to manage everyday expenses like food, gas and utilities.