Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: Droughts Causing Uncertainty in Key Shipping Lanes; New Zealand Dairy Prices Hit New Lows; and Butterfat in a Minute!

Quick Bites: New Zealand Milk Powder Struggles

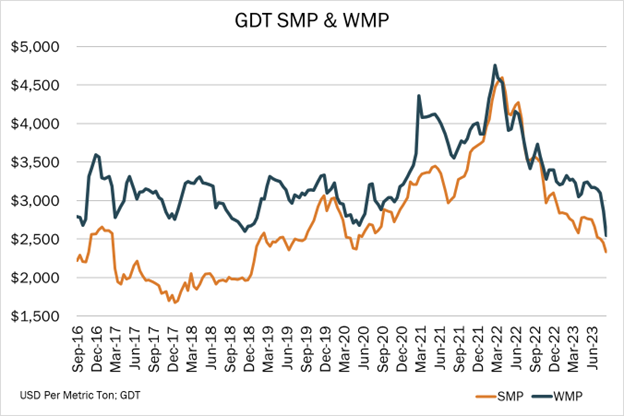

- Weak demand from China, along with ample supplies, are dragging New Zealand dairy prices to multi-year lows. At the latest GlobalDairyTrade event, skim milk powder fell to the lowest price since January 2019, helping take the overall auction index to a level last seen in April 2020. Whole milk powder also tumbled at the event and plunged further at the following Pulse auction to settle at the lowest level since August 2016.

- Further drops seem possible. Fonterra Cooperative Group announced earlier this month plans to increase the amount of SMP and WMP available for purchase at GDT events. New Zealand’s peak milk production season is also ahead, and NZX expects weather conditions to improve, buoying output, and, ostensibly, milk powder supplies.

- Demand from China – a primary buyer at GDT events – is also expected to remain sluggish as its economy struggles and domestic milk production remains robust. Year-to-date through July, the country’s total WMP imports declined 40% compared to 2022, though SMP purchases climbed more than 20%.

- Lower New Zealand prices are dulling the U.S. competitive edge. Through the first seven months of 2023, U.S. exports of NDM/SMP dipped 1% amid softer volume to China and Southeast Asia. And with CME spot prices at or near parity with values in Europe and New Zealand, the U.S. could struggle to gain footing in international markets.

Today's Special

- Drought conditions along the Panama Canal are creating uncertainty seas around key shipping lanes for agricultural commodities and other goods. Due to low water levels, the Panama Canal Authority has enacted restrictions along the waterway, including allowing just 32 vessels to cross each day. With over 100 ships queued, wait times this month averaged 10.4 days for northbound craft and 9.3 days for southbound transport, slowing shipping times ahead of the holiday shopping and peak import season. Many ships are also reducing loads by up to 40%.

- Restrictions could continue through the end of the year and beyond if the area doesn’t receive additional moisture. And prolonged issues on the canal could reduce revenues from the canal by $200 million in 2024, according to estimates by the Panama Canal Authority.

- Drought is also complicating U.S. transportation on the cusp of harvest season. Receding water levels on the Mississippi River are prompting shippers to reduce the amount of product loaded on barges. As a result, more barges will be needed to move the same amount of product, ultimately pressuring capacity and slowing downstream productivity.

- What does it all mean for U.S. exporters, importers and consumers? While barge rates have yet to react, ocean freight costs are rising. Many companies are increasing listed rates, causing the average cost to ship a 40-foot container from China to the U.S. West Coast to climb 61% in the past six weeks, per data by Xeneta. The increase is expected to be short-lived, however, as new containerships will soon add more capacity to a lackluster market. Worldwide rates also remain well below their “supply chain crisis” highs, with the Drewry Worldwide Shipping index down 70% versus September 2021 levels. Still, shoppers could face higher prices for food and gifts this holiday season.