Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: Changes in Grocery Store Costs; U.S. Employment Trends; and Quick Service Restaurant Sales in a Minute!

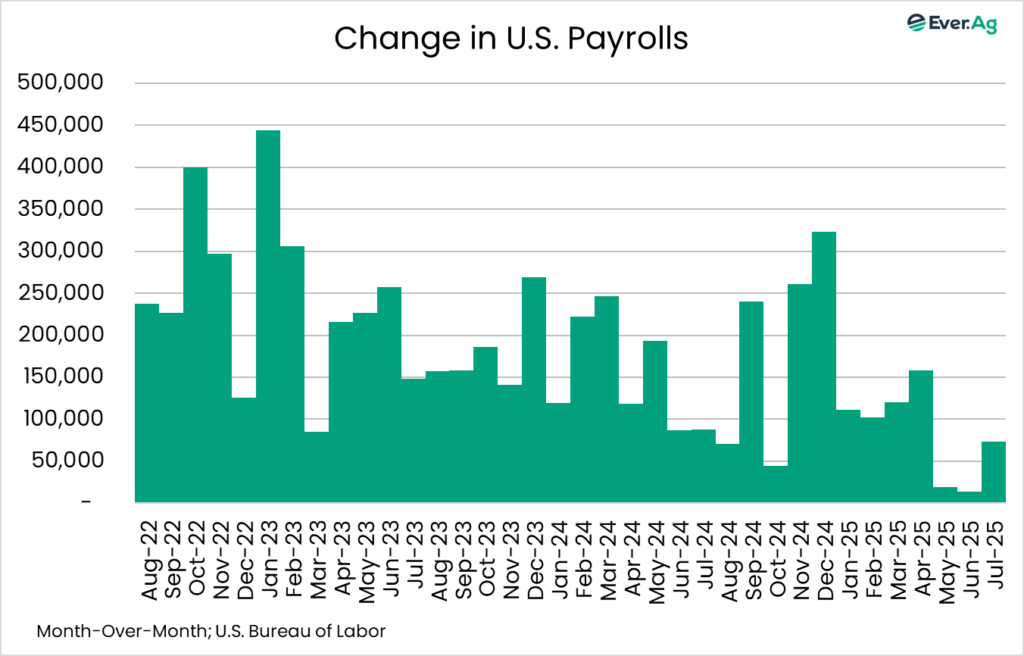

Quick Bites: Keeping an Eye on Employment Trends

- The job market looked a little less rosy to start the second half of 2025. U.S. Bureau of Labor Statistics data showed that payrolls expanded by 73,000 jobs in July. Job growth is good news, of course, but the expectation for July was +110,000 positions, so the market fell short of that prediction.

- What raised more eyebrows were the revisions to the May and June data. Initial reports added +144,000 jobs in May and +147,000 jobs in June. Modifications put May at +19,000 jobs and June at just +14,000 jobs. In total, 258,000 positions were wiped from the books.

- Unemployment for July came in at 4.2%, up from 4.1% the month before but in line with expectations. Looking closely, though, 130,000 people left the workforce that month, keeping joblessness under control. Meanwhile, the labor participation rate fell to 62.2%, the lowest mark since July 2022.

- The most striking shift came in continuing claims: at 1.97 million, they hit their highest level since November 2021. Continuing claims track people still receiving unemployment benefits after filing an initial claim, so the rise suggests more workers are struggling to land new jobs quickly.

- These numbers don’t mean the sky is falling on the economy. That’s because employment is a lagging indicator. Recessions don’t happen because of unemployment – unemployment happens because we have recessions. We watch these numbers closely, though, because if people start to lose their jobs – or fear they might lose their jobs – their spending habits could very well change

Today's Special

- Nearly half of all Americans admit that the cost of groceries is a major source of stress right now. That’s according to a recent poll by The Associated Press-NORC Center for Public Research Affairs. Another 33% said it was a minor stressor. Grocery costs gave more people stress than any other category, including the cost of housing, health care and child care.

- Groceries are an expense – and a stressor – that affects consumers of all ages. On the other hand, income was more correlated with stress level. Of Americans in the lowest income bracket, making less than $30,000 per year, 64% said grocery costs were a major stressor. That compared to about 40% of respondents making $100,000 or more.

- There could be a little relief in sight for stressed shoppers. The Consumer Price Index data for July showed that the Food Index was unchanged from June after climbing 0.3% the previous two months. While the Food Away From Home Index rose 0.3%, food at home decreased 0.1%.

- Three of the major grocery store food group indexes decreased, two increased, and one was unchanged in July. Declines were realized in the juices and nonalcoholic drinks, cereals and bakery, and other indexes. Fruits and vegetables were unchanged over the month. Prices were up slightly in the dairy aisle, though. The index for dairy and related products rose 0.7% over the month. Milk specifically was up 1.9%. The meats, poultry, fish, and eggs index advanced 0.2%, with eggs down 3.9% but beef up 1.5%.

- While the Food Away From Home index was up, people are still supporting pizza places and the cheese that comes with it. Placer.ai traffic data for July showed a 3% increase in average daily visits to seven of the nation’s top pizza chains, and the trend carried into the first week of August. That’s seemingly positive news for cheese demand if the trend continues above year-prior levels.