Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: Consumer Credit Update; Butterfat on the Rise; and the Summer Grilling Season in a Minute!

Quick Bites: Butterfat on the Rise

- A few decades ago, butter was considered a villain in healthy diets. In the 1970s, media reports placed full-fat dairy products in a negative light because of unsubstantiated health concerns. But after decades of turning away from butter and other full-fat dairy foods, consumer perceptions and purchases have shifted toward higher-fat varieties. Many say that a 2014 cover story in Time magazine entitled “Eat Butter” solidified the turning point. Butter prices have reached record heights in the years since.

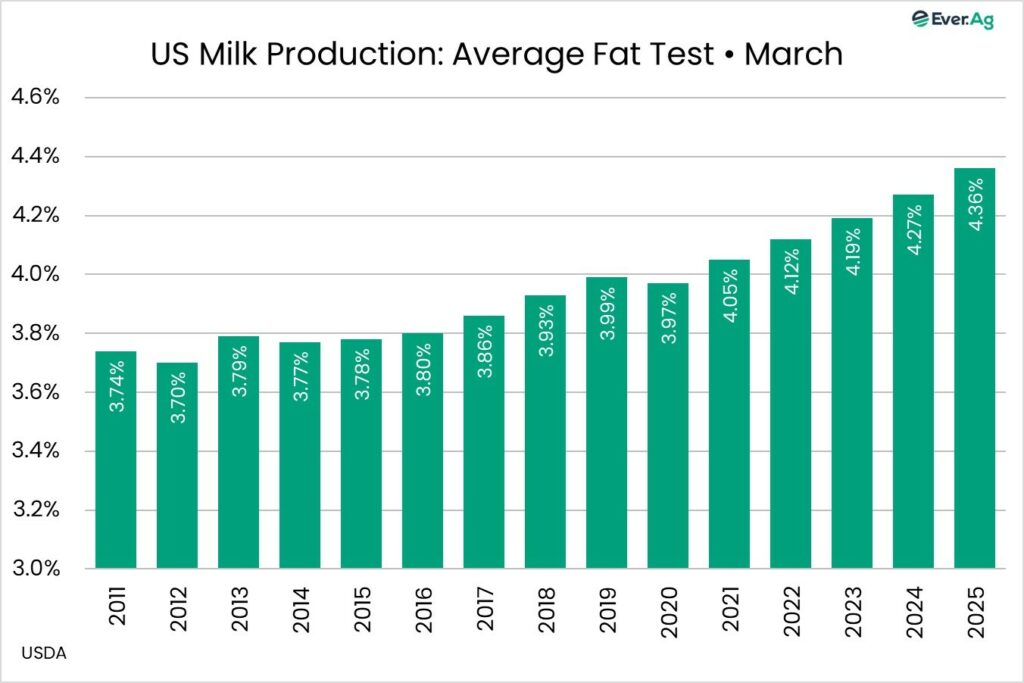

- Farmers – and their cows – responded by increasing the fat content in milk. Not that long ago, a good goal for a Holstein herd was 3.75% butterfat. Now, herds have pushed over 4.0% butterfat, and the number keeps climbing.

- The national average butterfat test for March was 4.36% – up from 4.27% a year ago. This extra fat translates to 25 million pounds of additional butterfat for the month. That’s an estimated 250 truckloads of cream per week and about 30 million pounds of additional butter production.

- Several factors contribute to this butterfat boom. On the cow-side, genetics continue to improve, and farmers have better tools to select for animals that will excel at milk and fat production. Great strides have also been made in dairy cattle nutrition. From progressive ration formulation, enhanced forage quality, stepped-up feed storage and better feed bunk management, cows are set up for success in terms of milk yield and component production.

- Butterfat has also become more valuable in recent years. Between 2005 and 2014, the average U.S. butterfat price in the Federal Milk Marketing Orders was $1.71 per pound. Between 2015 and 2024, the average price skyrocketed 48% to $2.53.

Today's Special

- The current consumer credit story is a mixed bag. According to the Federal Reserve Bank of New York, total outstanding consumer credit was $18.20 trillion at the end of the first quarter. That was up 0.9% from the last quarter of 2024 and +2.9% compared to the first quarter of last year. The overall amount of credit hit a new record high, but the year-over-year growth was the smallest since early 2021.

- Credit card balances declined to $1.18 trillion, down 2.4% from the fourth quarter of 2024. This was up 6.0% compared to a year ago, but it was the smallest year-over-year increase since the fourth quarter of 2021. Balances often shrink in the first quarter as consumers pay down holiday debt, but this yearly decline was the biggest since 2021.

- Fewer people are falling behind on credit card payments as well. Credit card delinquencies for the first quarter represented 8.8% of credit cards, down from 9.0% last quarter. Serious delinquencies, over 90 days late, fell to 7.0%, down from 7.2% last quarter. This was the lowest level since the first quarter in 2024.

- Debt issues may be improving slightly, but the thought of inflation fuels fear in consumers. In preliminary results for the May University of Michigan Sentiment Survey, year-over-year inflation expectations rose to +7.3%, up from predictions of 6.5% in April. The overall sentiment reading came in at 50.8, down from 52.2 in April and the second lowest reading in the history of the survey.

- Not all current consumer behavior reflects this concern, though. While many quick service restaurants took a hit in the first quarter, people have not completely curbed their eating out habits. For instance, the food delivery service Door Dash had a solid start to the year with increases in both order volume and revenue. The company reported that 732 million orders were fulfilled during the first quarter, 11% higher year-over-year, with revenue reaching $3.03 billion, up 21% compared to the first three months of 2024.

- Restaurant traffic remains below year-ago levels, but it has been improving month-to-month since February. In general, consumers seem to be spending despite their pessimism in the overall economy.