Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: Drops in Restaurant Sales; Comparing Food Inflation and Wages; and Passport to Europe in a Minute!

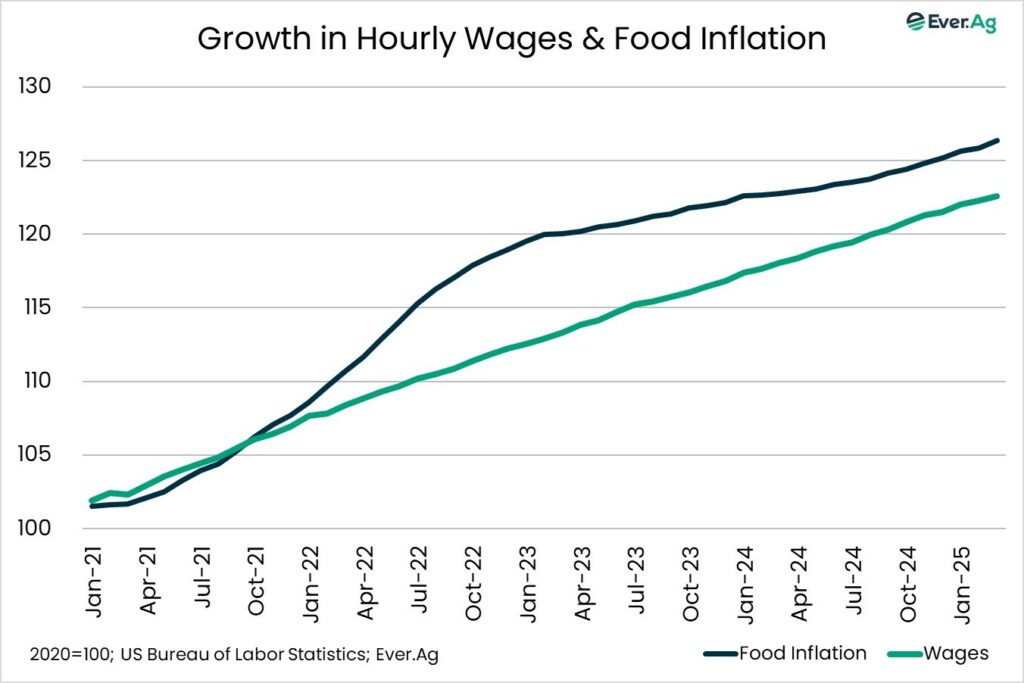

Quick Bites: Food Inflation Outpaces Wages

- Food costs have been increasing at a faster clip than wages since October 2021. This difference shows up in consumer buying and eating patterns and their overall confidence in the economy.

- The Consumer Price Index for all goods and services rose just 0.2% from March to April and was up 2.3% compared to March 2024, the smallest 12-month increase since February 2021. Lower energy costs made the difference, with prices up 0.7% from March but down 3.7% the past 12 months.

- The price tag for food was a different story. Over the past 12 months, the food index rose 2.8%. More recently, the April food index stepped back 0.1%, with food at home decreasing 0.4% month-over-month but still up 2.0% year-over-year. Food away from home was up 0.4% from March and +3.9% the past 12 months. This was the highest year-over-year increase since September 2024.

- Average hourly earnings for all employees on private nonfarm payrolls did rise by 6 cents (+0.2%) to $36.06 and, over the last year, average hourly earnings increased by 3.8%. The unemployment rate came in at 4.2%, unchanged from the month before. It has remained in a narrow range of 4.0% to 4.2% since May 2024. Total nonfarm payroll employment grew by 177,000 jobs in April. This was not far off from the average monthly gain for the prior 12 months.

- The wage and job situation does not spell doom and gloom. However, consumer sentiment is at its lowest point since July 2022, and Americans expect year-ahead inflation to sit at 6.5%. This was the highest reading since 1981. Sticker shock on grocery shelves does not help to calm consumers’ nerves, especially when wages are not rising at the same pace.

Today's Special

- Several prominent restaurant chains recently released first quarter results for 2025, and it wasn’t pretty. Same-store sales were down 5.0% year-over-year at Pizza Hut and -3.0% at Papa Johns. For McDonald’s, sales fell 3.6%. Starbucks was down 2.0% year-over-year, and Domino’s reported a loss of 0.5% in same-store sales.

- During this same timeframe, food-away-from-home inflation averaged 3.7% year-over-year. So, volume sales were probably even lower than the same-store sales because restaurants took in fewer dollars even though menu prices were higher.

- There were a few bright spots in quick service restaurant sales. Taco Bell reported Q1 sales up 9% year-over-year. Their secret sauce? Menu items such as the “$5-$7-$9 Luxe Craving Boxes” that appeal to consumers looking for value at a lower cost. We know that lower-class and middle-class consumers are struggling, and if they can’t find a good deal, they are more likely to eat at home, as has been indicated in the recent uptick in grocery store traffic.

- Reduced sales for the big three public pizza chains – Domino’s, Papa Johns, and Pizza Hut – means fewer dine-in and take-out pizzas. And faltering pizza sales represents lost cheese consumption likely not replaced pound-for-pound at home. According to USDA, March domestic cheese demand was down 1.6% year-to-date, year-over-year.

- Americans eat 3 billion pizzas annually. If we assume each of those pizzas is topped with eight ounces of cheese, 1.5 billion pounds of cheese are used on pizzas each year. A 1% decline in pizza intake reduces cheese use by 1.25 million pounds per week – the equivalent of 28 truckloads of cheese.