Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: Restaurants Outpacing Grocery Sales; Increasing Milkfat Content in Fluid Milk; and Grains in a Minute!

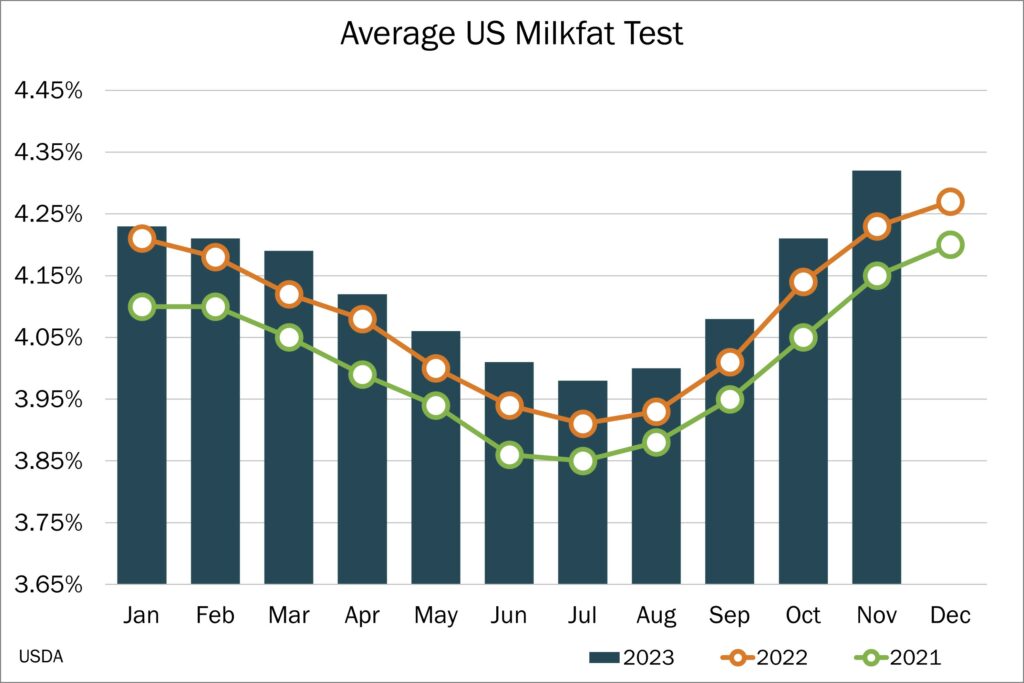

Quick Bites: Fat on the Rise

- When it comes to milk output, it’s not always about quantity. Quality matters, too. Total milk production has been up and down in recent months, but one trend has been relatively consistent: increasing milkfat content.

- The popularity of low-fat diets has been on the wane, and Americans are turning more and more to butter and cheese. According to USDA data, in 2022 Americans ate an average of 42 pounds of cheese, up 17% compared to the previous decade. Butter demand in 2022 was at 6.0 pounds per person, up 9% from 2012. On the whole, dairy product consumption on a milkfat basis jumped 6% compared to 2012.

- What does that mean for dairy? It means there’s more need for fat as more milk goes to cheese plants and butter churns instead of to bottling plants. Pay prices often reflect this value, paying producers more for higher fat content. And dairy producers are responding. In the short-term, they’re changing up their feed mixes to encourage higher fat content. They’re also making long-term changes when it comes to breeds, trading in their high-volume Holsteins for high-fat Jerseys. Others are breeding their Holstein cows with Jersey bulls to get the best of both, affectionately referred to as HoJos.

- The changes appear to be working. On-farm butterfat has been growing steadily, remaining consistently above prior-year levels. In 2011, milkfat was at an average of 3.71%. By 2022, it was almost 4.09%, and for the first 11 months of 2023, it averaged 4.13%. Those are the highest numbers since at least World War II. It’s a trend that’s likely to continue as long as Americans like butterfat.

Today's Special

- Americans love eating out. Just how much that’s true became clear in 2015 when spending at U.S. food service outlets surpassed grocery store revenue for the first time. That year, restaurants took in $10 billion more than grocery stores according to U.S. Census Bureau data. That gap continued to widen, reaching $83 billion in 2019.

- Then Covid hit and flipped the food industry on its head. Restaurant spending dropped from $766 billion to $621 billion while grocery stores went from $683 billion to $767 billion. The turnabout lasted only one year, however, with restaurants racing right back out in front in 2021 as food service operations regained their footing. In 2023, restaurant spending topped $1 trillion for the first time, and outpaced grocery stores by more than $200 billion.

- Measuring dollars isn’t the same as measuring volume, and aggressive food-away-from home inflation has certainly played a role in propelling the restaurant figures. But when adjusting for price changes, restaurant growth still comes out on top, hinting at the possibility that more food volume is moving through that channel. Indexing against inflation back to 2018, restaurant sales were still ahead of food service sales by 21% (compared to +23% on an unadjusted basis).

- What does this mean for the dairy industry? Manufacturers and marketers likely have to continue to invest more in developing products for the restaurant space, focusing on convenience, portability and cost management in a way that makes it easy for operators to choose more dairy for their menus.