Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: Inflation Shows Signs of Improvement; Easter Spending Reaches Historical High; and Grain Roundup in a Minute!

Quick Bites: A Bigger Easter Basket

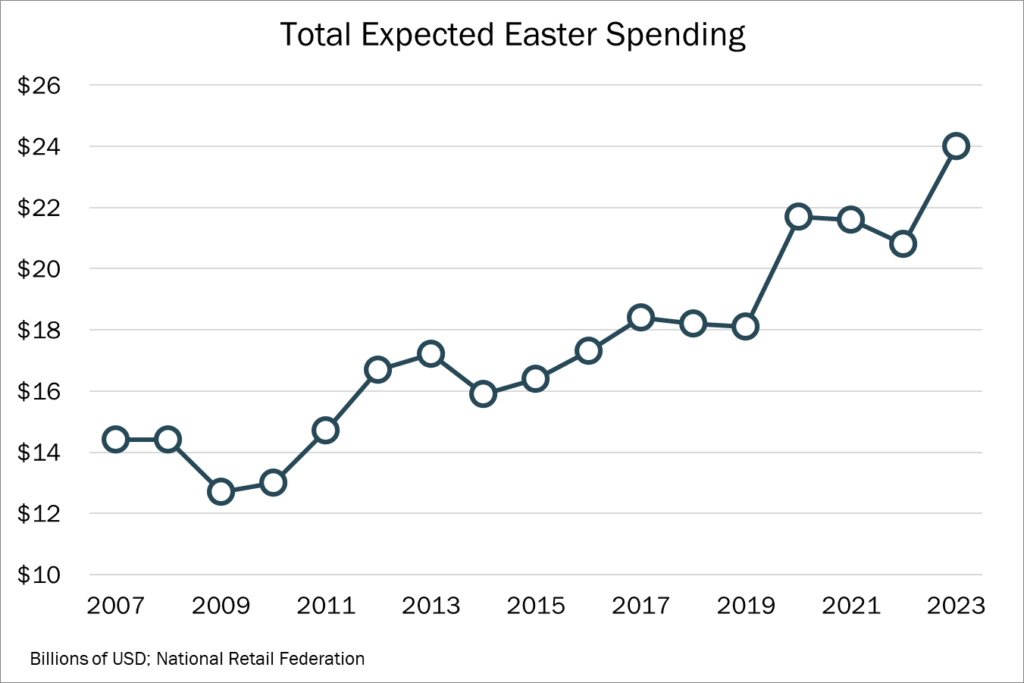

- Easter spending likely reached a historical high this year – and inflation may not deserve all the credit. Forecasts by the National Retail Federation pegged total dollars at $24 billion, ahead of the previous record of $21.7 billion reached in 2020. On average, NRF expected Americans to spend an average of $192, a new high.

- Food remains a priority among those who celebrate. More than half of consumers – 56% – planned to cook a holiday meal, with total food spending expected to reach $7.3 billion. Dairy likely played a significant role at the table, with cheese purchases up roughly 1% and butter sales rising more than 14% year-over-year in the week leading up to the holiday.

- Consumers also planned to spend significant amounts on clothing ($4.0 billion), gifts ($3.8 billion) and candy ($3.3 billion). Price remains top of mind, with 54% of consumers planning to look for bargains at discount stores, though that was relatively in line with previous years. Department, local/small and specialty stores, as well as online retailers, were also top shopping destinations.

Today's Special

- After elevated prices slowed consumer spending last year, inflation – and grocery sales – are showing some signs of improvement. In March, food-at-home prices decreased 0.3% month-over-month, the first drop in more than two years. Dairyinflation also dipped 0.1% on the month.

- The slowdowns may have tempted consumers to put a few more dairy products in their shopping carts. Persons familiar with scanner data suggest retail butter purchases in March increased 8% year-over-year as average promotional prices tumbled more than 13% on the month.

- Cheese sales were slower, rising less than 1% versus prior-year levels as prices increased 8% on the year. Ice cream sales declined more than 3% year-over-year in March as prices more than doubled, per scanner data.

- But high prices continue to beleaguer sales of more indulgent items. According to persons familiar with scanner data, retail milk and ice cream purchases each declined more than 1% year-over-year during the first three weeks of March. But sales of cheese and butter rose roughly 1% and 5%, respectively, over prior-year levels.

- Meanwhile, fewer retailers are promoting dairy products. The number of stores advertising butter averaged 4,763 in March, down 6% on the month and -33% on the year. An average of 11,115 stores promoted shredded cheese in March, up 6% versus February, but down 3% on the year.