Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Blimling and Associates, Inc., a dairy research and consulting firm based in Madison, Wisconsin. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: War in Ukraine Impacting Global Food Availability & Prices, Natural Gas Skyrockets, and Cheese Markets in a Minute!

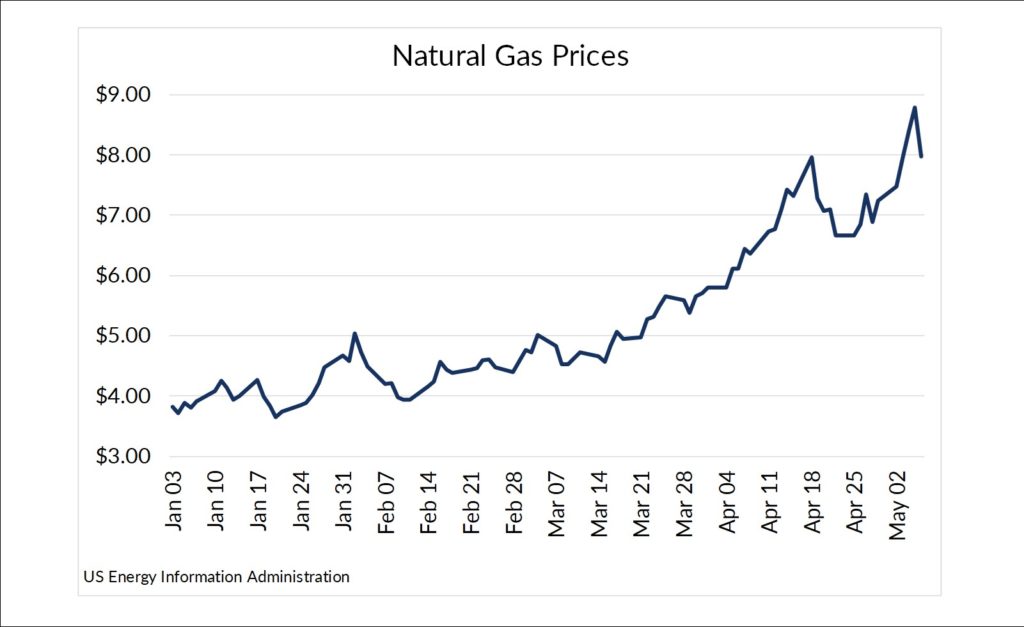

Quick Bites: Natural Gas Skyrockets

- Russia’s invasion of Ukraine and the resulting clashes have added yet another complication to global supply problems, particularly when it comes to energy.

- Tighter oil and natural gas markets are making themselves felt around the globe as countries pull on limited resources. The World Bank pegged global energy prices for March at 448% higher than two years before.

- Europe, which depends on Russia for 40% of its oil and natural gas, is in a particularly tough spot. At the start of May, natural gas inventories in Europe were 18% below the pre-pandemic five-year average. The natural gas benchmark reached $8.783 per million BTU, more than double the cost at the start of the year and well above the 10-year average of $3.00.

- The dairy industry isn’t insulated from these energy market upheavals. In April, Russia cut off natural gas supplies to Bulgaria and Poland. Poland is a major producer and exporter of SMP, and it takes natural gas to run the dryers. While Poland is still receiving gas via Germany, there’s much less supply available. With natural gas more expensive, producers in Poland and other EU countries may choose to redirect milk to cheese manufacturing, which is less gas-dependent, instead of to powder dryers.

- In the short-term, Europe is struggling to find alternatives. Some nations have taken to importing liquefied natural gas (LNG), but receiving infrastructure is a limiting factor. European farmers are turning to biogas production as a move toward independence. But using crops to make energy might not be the best move with food supply at risk, too.

- Over the long-term, markets work. Rising prices will discourage demand and shortages will lead to more ingenuity and alternative sources of supply. Government responses and the world’s political landscape will also guide Europe’s path to energy independence in the years ahead.

Today's Special

- The war in Ukraine and the resulting sanctions against Russia sent shockwaves around the globe and impacted everything from shipping times to cooking oils. As countries struggle to find their new footing, one of the major questions facing analysts and leaders alike is: How are the ripples impacting food availability and prices?

- Farmers across the world were already struggling with climbing fertilizer costs. But sanctions against Russia as well as China’s and Russia’s bans on fertilizer exports are causing prices to shoot even higher. In March U.S. prices for anhydrous ammonia alone jumped 130% year-over-year. That’s making farmers in South America and the U.S. think twice about how much corn they want to plant.

- Meanwhile, the prospects for Ukraine crops seem bleak. Before the invasion, the country was responsible for 14% of the world’s corn exports, 10% of the wheat and 50% of the sunflower oil.

- But the disruptions of war have prevented Ukraine from maintaining its high productivity as a breadbasket of Europe. Farmers have taken up guns instead of plowing fields. Areas once occupied by Russian forces are littered with landmines, forcing farmers to cease planting on some fields altogether. It will likely take months or years before Ukraine’s output can return to pre-war levels.

- At the same time, unfavorable weather in grain-growing regions in South America and India are cutting into the world’s food supplies even further. A cool, wet spring is delaying the U.S. planting season, adding further anxiety.

- Grains aren’t the only product with declining availability. Cooking oil supplies are falling and prices are skyrocketing across the globe. That’s particularly true for sunflower oil, a major export of Ukraine and Russia. Vegetable oil prices reached record highs in March, with soybean oil up 156% versus 2019 and palm oil up 200% in the same time period.

- The impact is being felt around the world, from protests in Indonesia to closure of some of England’s famed fish-and-chips shops and even reduction in cosmetics and soap production. Countries in Asia and the Middle East in particular, where millions depend on imported food stocks and government subsidies, are searching for new sources to avoid shortages.

- The global crisis is creating opportunities for U.S. farmers and producers as countries that are finding their normal sources unavailable look for new markets. The capacity of U.S. export terminals may become a bottleneck limiting how much actually leaves the country. But the resulting shortages and rise in prices are likely to have impacts that are long-lasting and far-reaching.