By Mike Aquino, director, ESG, International Dairy Foods Association

Legislative Update: On October 7, 2023, California's Governor Newsom signed both CA SB-253 and SB-261 into law. As the regulatory process associated with these bills moves forward, IDFA will update members with timely information pertinent to our business community. See: https://www.gov.ca.gov/wp-content/uploads/2023/10/SB-253-Signing.pdf

Earlier this month, California legislators passed the first mandatory climate disclosure bills in the United States as part of a “Climate Accountability Package.” If signed into law, these corporate disclosure requirements will be administered by the California Air Resources Board (CARB).

The two bills—one mandating greenhouse gas (GHG) emissions reporting and the other requiring climate-related financial risk disclosures—aim to drive transparency and progress in corporate climate risk management. Governor Gavin Newsom has stated his intention to sign both bills pending minor revisions and is expected to sign them before October 14.

Below are summaries of the bills, information on how these bills will impact dairy businesses, and three recommendations for dairy businesses.

Bill Summaries

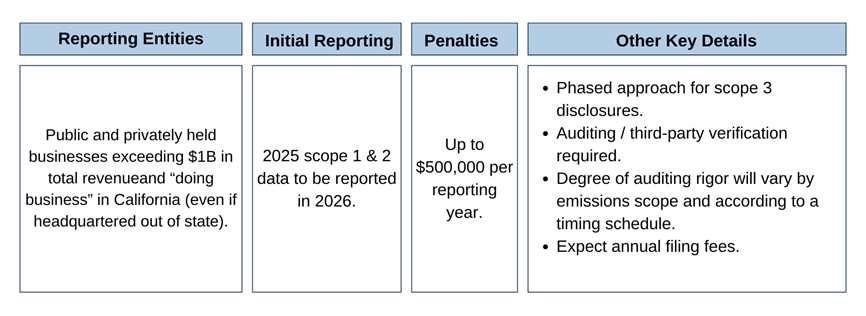

#1: SB-25: “Climate Corporate Data Accountability Act”

Regulatory Focus: Greenhouse gas emissions reporting—including scopes 1, 2, & 3—according to GHG Protocol standards.

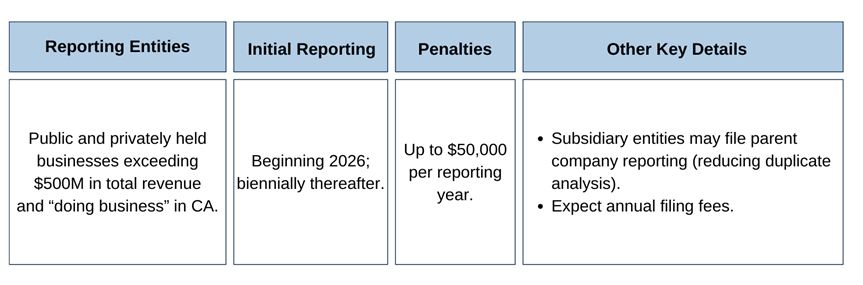

#2: SB-261: “Climate-Related Financial Risk Act”

Regulatory Focus: Climate-related financial risk reporting—including associated measures to reduce/adapt (i.e., manage) stated risks—according to Task Force on Climate-related Financial Disclosures (TCFD) standards/guidance.

While the California bills described above are the first of their kind in the United States, similar climate-related reporting requirements are already in force abroad (e.g., the EU’s “CSRD” regulation). And these legislative developments are similar in substance to the proposed Securities & Exchange Commission (SEC) climate disclosure rule. These emerging regulations parallel numerous marketplace indicators signaling a shift from voluntary to mandatory corporate Environmental, Social and Governance (ESG) disclosures. Even absent regulatory mandates, the dairy community should continue working to further build capacity and consensus around best practices for GHG and climate risk accounting and reporting.

While similar in substance, the California bills differ from the pending SEC rule in scope. In California, CARB will require reporting from both privately held and publicly traded companies according to a total—not state-specific—revenue threshold. At this time, it is estimated that more than 5,000 and 10,000 companies will be affected by SB-253 and SB-261, respectively.

Specifically, the bills define “reporting entities” as follows:

| SB-253, Section 2(2) | “Reporting entity” means a partnership, corporation, limited liability company, or other business entity formed under the laws of this state, the laws of any other state of the United States or the District of Columbia, or under an act of the Congress of the United States with total annual revenues in excess of one billion dollars ($1,000,000,000) and that does business in California. Applicability shall be determined based on the reporting entity’s revenue for the prior fiscal year. |

| SB-261, Section 2(4) | “Covered entity” means a corporation, partnership, limited liability company, or other business entity formed under the laws of the state, the laws of any other state of the United States or the District of Columbia, or under an act of the Congress of the United States with total annual revenues in excess of five hundred million United States dollars ($500,000,000) and that does business in California. Applicability shall be determined based on the business entity’s revenue for the prior fiscal year. “Covered entity” does not include a business entity that is subject to regulation by the Department of Insurance in this state, or that is in the business of insurance in any other state. |

More details, specific dates, and procedures will come to light as CARB prepares its administrative program. Member companies should consider that the intention of these mandates is, in part, public disclosure (i.e., the reporting is not limited to being viewed by CARB or the State of California). Importantly, not all emissions reporting will be required at once. SB-253 calls for scope 1 and 2 reporting to begin with 2025 data (due in 2026). Until 2030, scope 1 and 2 data will be evaluated according to “limited assurance” auditing rigor, with “reasonable assurance” required thereafter. Scope 3 reporting will be required beginning in 2027 (using previous fiscal year data), but companies will only be penalized for not filing until 2030. After 2030, scope 3 data will be held to expectations of limited assurance.

IDFA views this assurance engagement schedule as an acknowledgement of the high risk for scope 3 estimations and inconsistencies given current GHG Protocol standards and current scope 3 accounting capabilities. Perhaps acknowledging the administrative burden (and costs) associated with generating public disclosures, it appears that CARB’s compliance requirements will align with other regulatory bodies requiring similar data, such as the SEC.

What does this mean for members concerned with farm-level GHG accounting and traceability?

Scope 3 accounting requires collaboration and engagement between reporting entities along the value chain. A retailer’s scope 3 profile includes a processor’s scope 1 and 2 emissions just as a processor’s scope 3 includes a portion of the producer’s carbon “footprint.” In the case of consumer food and beverage product value chains, it is widely acknowledged that scope 3, which is the most difficult to account for, is of utmost importance to determine, report, and manage as part of a meaningful climate change mitigation strategy.

The SB-253 text provides lead time for both CARB and reporting entities to determine best practices and industry norms for emissions reporting according to GHG Protocol. It is widely acknowledged that individual farm GHG inventories are not always available, may be modeled, and that commodities like dairy—which are co-mingled, disaggregated, and globally traded—inherently require some estimation. In fact, the GHG Protocol gives corporate reporters flexibility to choose between primary and secondary data (i.e., emissions factors) in scope 3 accounting.

IDFA anticipates that further discussion and investigation will be necessary to navigate tensions between emissions granularity and logistical realities. For more on this topic, please see the recent Global Dairy Platform (GDP) position paper on the topic of mass balancing in carbon accounting.

IDFA will collaborate with the Dairy Institute of California to identify potential avenues of engagement and influence as CARB proceeds with its regulatory development process. In the meantime, IDFA will work to provide timely guidance and support to members about the details of preparing corporate climate disclosures. While we know that many member organizations are already prepared for at least scope 1 and 2 GHG Protocol-aligned reporting, we suspect more learning is needed related to TCFD analysis. A recommended starting point for your sustainability/ESG leaders is found here.

Like the SEC proposed climate rule, IDFA finds California’s legislation troublesome in that it places undue burden on organizations all along the dairy value chain, including at the farm level. In the attached press statement, we express this concern. More engagement with industry is necessary to reach a point at which disclosures, whether voluntary or mandatory, are able to be developed with more accuracy and consistency. This is especially relevant to scope 3 (i.e., value chain emissions) measuring, monitoring, and reporting.

What actions should dairy businesses take?

- Resource up. Make sure your leadership team is aware of the need to assign resources and increase internal capabilities for sustainability and ESG reporting. Many organizations are elevating ESG and sustainability management to the Board level as they transition from “check the box” type sustainability actions to consideration of how ESG agendas may help manage business risks.

- Address what is under your control first. GHG emissions are categorized into scopes (1, 2, & 3) for practical reasons—not all emissions connected to any given business operation are onsite and under that company’s direct control. It is pragmatic to address scope 1 and 2 emissions first, and you may find that your utility providers are able to help with part of that (along with many third-party tools). Consider starting points such as:

- The Dairy Processor Handbook, which includes GHG reduction opportunities guidance.

- The SME Climate Hub

- Leverage business relationships. IDFA recommends learning what you can from both suppliers and customers. For instance, some major retailer customers have ramped up annual questionnaires and data requests, but—in parallel—they’ve partnered with NGOs and sustainability consultancies to help suppliers along the way. Consider forming a cross-functional task force with your organization’s procurement leaders to look for any responses you’ve already provided to customers as starting points for your own reporting.

---

IDFA members with questions and concerns should reach out to me at maquino@idfa.org or IDFA Vice President of Regulatory Affairs & Counsel, Danielle Quist, at dquist@idfa.org.

IDFA Staff Expert

Mike Aquino

Director, ESG