Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: China Dairy Sources Shifting; Consumer Sentiment Continues to Fall; and Cheese in a Minute!

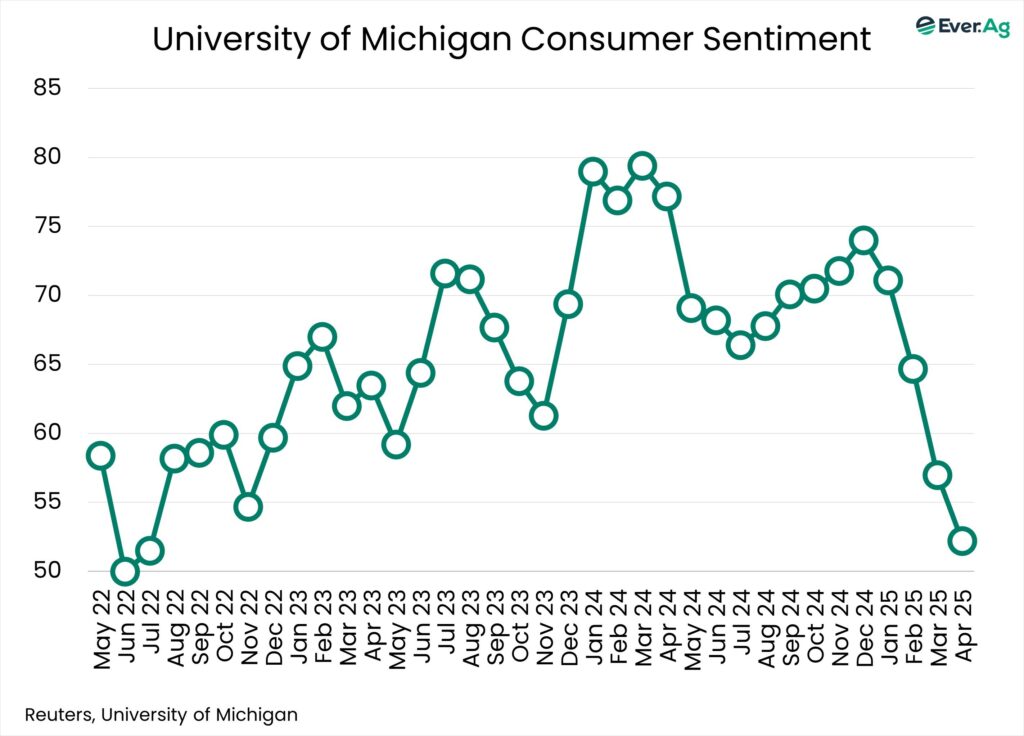

Quick Bites: Consumer Sentiment Falls Further

- Consumer sentiment plunged 8% in April compared to the month before. The final University of Michigan Consumer Sentiment Index reading for the month was 52.2, down from a rating of 57.0 in March. This was the lowest reading since July 2022 and the fourth-lowest rating on record going back to 1952.

- Part of the issue: Americans anticipate greater inflation in the coming year. Expectations for year-ahead inflation rates surged from 5.0% last month to 6.5% this month. This was the highest reading since 1981 and the fourth consecutive month of abnormally large increases of 0.5 percentage points or more.

- With the fear of inflation and global trade uncertainty, consumers appear cautious. The survey ran from March 25 to April 21, a period that included many up-and-down tariff announcements. While March showed some economic improvements, including job growth and a low 4.2% unemployment rate, there were also signs of hesitation. For example, March sales of existing homes posted the biggest monthly decline in more than two years.

- Sentiment deteriorated among middle-income households the most, but they were not alone. Expectations fell for a broad range of participants across various age, education, income and political affiliation categories, according to Joanne Hsu, director of the University of Michigan’s Surveys of Consumers. Upper-income households have been pulling the American economy along, but if these consumers start to cut back on retail spending and restaurant meals, impacts could be felt in the dairy industry and beyond.

Today's Special

- Export markets are important avenues for U.S dairy. About 17% of U.S. milk production is turned into products sold overseas. That is more than a day’s worth of milk output each week.

- Recent tariff news has put many industries on edge, and dairy is no exception. Last year, dairy exports totaled $8.3 billion, the second highest value in history. Mexico and Canada represent dairy’s top two export destinations, with 40% of U.S. dairy exports heading north to Canada and south to Mexico. Fortunately, tariff chatter involving these two countries has been muted as of late.

- On the other hand, tariff activity with China – our third-biggest dairy export customer – has been anything but quiet. The current situation includes 125% tariffs on U.S. goods heading to China and 145% tariffs on Chinese products bound for the U.S. Last week, President Donald Trump alluded to possible reductions in tariffs for China, but no official announcement has been made yet.

- From a dairy product standpoint, tariffs against China stand to impact whey the most. China imports a lot of whey from the U.S. – 38% of U.S. whey exports were China-bound in 2024. And 17% of all whey produced in the U.S. last year headed to China. Most of that whey is used to feed piglets.

- Will a trade war and tariffs lead China to find another whey source? Recent import data shows China is already shifting its lactose and high-protein whey purchases away from the U.S. and turning instead to European countries. However, this might not be all bad for the U.S. If the EU shifts more whey exports to China, other countries may be looking for a new source, potentially opening doors for the U.S. Disruptions to supply chains are never seamless, though, and there can be added costs as well. A lot hinges on the tariff situation with China. Stay tuned.