Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Blimling and Associates, Inc., a dairy research and consulting firm based in Madison, Wisconsin. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

U.S. Dollar Gaining Value Despite Inflation; China Moving Towards Dairy Independence; and Discretionary Spending in a Minute!

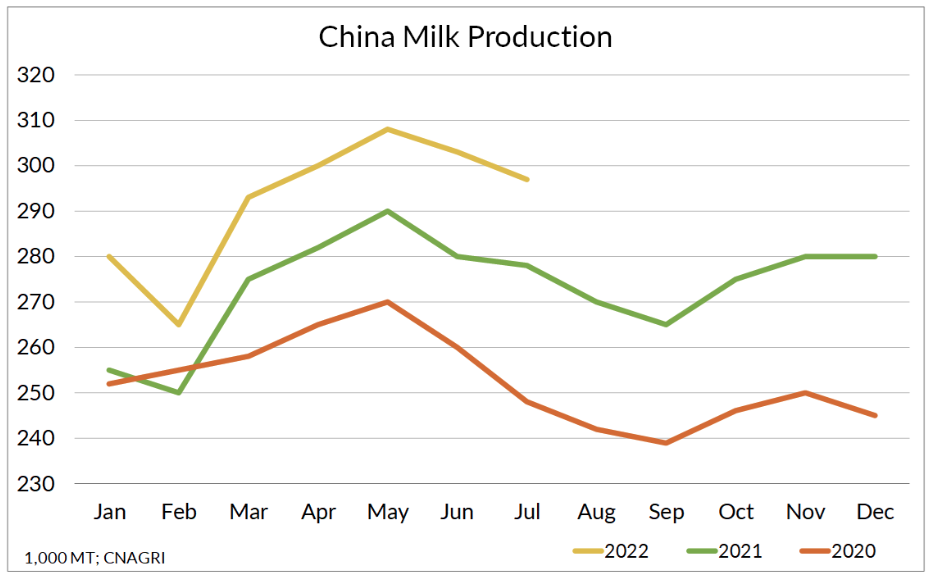

Quick Bites: China Making Progress Toward Dairy Independence

- China’s dairy industry is progressing toward self-sufficiency. In July, the country’s milk production reached 297,000 metric tons, up nearly 7% year-over-year. That brought output for the first seven months of the year to 2.0 million metric tons, a gain of more than 7% versus the same period in 2021.

- That strong performance is likely to continue, with Rabobank forecasting a 5% increase versus prior-year levels during the second half of 2022, followed by 3% increases during the first and second halves of 2023. Growth could be limited, however, by a record heat wave and drought, as well as easing margins. Still, Rabobank says it believes that China’s dairy industry may be approaching 80% self-sufficiency this year, compared to about 75% in 2021 and 70% in 2018.

- Meanwhile, China’s dairy imports are easing. In July, combined SMP and WMP imports fell 46%, inbound shipments of whey decreased by 17%, and cheese imports fell 26% versus prior-year levels. Rabobank suggests the country’s dairy imports for the full year will decline 43% versus 2021, even as ending stocks rise.

Today's Special

- Inflation is high and consumer sentiment is low, but the U.S. dollar is gaining value. During the week ending September 2, the USD Index closed at 109.51, up 0.7% on the year and +21.9% year-to-date. This year, the greenback also passed parity with the Euro for the first time in two decades and reached its strongest showing against the pound since 1985. And it’s well above the Japanese yen, which last month hit the lowest level since 1998.

- A robust dollar is helping offset rampant inflation. During the month of August, consumer prices rose 0.1% month-over-month after a flat reading in July. Inflation also rose 8.3% on the year, though that was a slight improvement from +8.5% the month prior, due largely to cheaper fuel and cars. Still, food inflation remains hot, with overall prices jumping 0.8% from the previous month and +11.4% versus the year before.

- Meanwhile, elevated inflation is driving up costs for importers of U.S. product. That’s likely to fuel even higher prices in countries also facing inflationary pressures. Eurozone inflation reached an all-time high last month, and prices in the UK rose by double digits in July. That may lead importers to pick up fewer American goods.

- Weakness could be ahead for the dollar. Analysts say the latest jobs data strengthened forecasts for another rate increase from the Federal Reserve. A 0.75% hike is expected this month.