By Mike Aquino, director, ESG, International Dairy Foods Association

The U.S. Securities and Exchange Commission (SEC) today voted to finalize their climate disclosure rules, which provide requirements for domestic publicly traded corporations to begin reporting on their climate-related risks, impacts, and management strategies. While the SEC initially proposed to include Scope 3 (i.e. value chain) emissions in these reporting requirements, this emissions scope is excluded from the final rules.

In 2022, IDFA took a leading role in advocating for changes to the SEC’s proposed rulemaking to improve outcomes for the dairy value chain and request greater flexibility regarding implementation and timelines, so the ultimate regulatory and market burdens are lessened on the dairy industry as we continue to lead the food and beverage sector in practicing responsible environmental, social, and governance principles. We expressed concerns about the impacts of the proposed rules on business entities not regulated by the SEC, including privately held companies and farms.

We filed comments to the SEC in June 2022. We broke down the proposed rule in this 3-part blog series, and we partnered with PricewaterhouseCoopers to provide our members with webinars, reporting guidance, and an ESG knowledge hub. Find all of those resources here. That is why IDFA believes the SEC decision to exclude Scope 3 emissions is a recognition of U.S. dairy’s—and U.S. agriculture’s— leadership on sustainability, as well as our nation’s voluntary, incentive-based sustainability policies.

While the SEC has stepped back from mandatory climate disclosure, state climate disclosure mandates may still impact dairy processors. Notably, California passed a three-bill “Climate Accountability Package” in the Fall of 2023, which will impact many IDFA members doing business in California. We also know that member companies doing business internationally may be subject to reporting requirements such as the European Union’s Corporate Sustainability Reporting Directive (CSRD). Furthermore, companies may continue to feel pressure to report (if not already doing so) to several voluntary frameworks of interest to your customers, NGOs, and the investment community.

Climate-related Disclosure Requirements: Where Do We Stand?

Major Regulatory Frameworks of Interest to IDFA Members:

| Jurisdiction & Policy | Anticipated Initial Reporting/Filing Requirements | Scope | Status |

| U.S. Securities & Exchange Commission (SEC): Climate Disclosures Rule | 2025 on FY24 | Direct: US publicly traded corporations. Indirect: Upstream/downstream suppliers and farmers. | *March 6, 2024 Update* “Scope 3” emissions excluded from requirements. |

| European Union: Corporate Sustainability Reporting Directive (CSRD) | 2025 on FY24 | Direct: Public and private businesses according to phased approach based on company characteristics. Indirect: Upstream/downstream suppliers and farmers. | Phasing in as of 2024. |

| California Climate Accountability “Package”: SB 253, SB 261, & AB 1305*. | Varies: initial reporting anticipated to be required in 2026 on FY25 data (with a phased approach for scope 3 auditing rigor); AB 1305 disclosures may be required online as early as 2024. | Direct: Public and private businesses according to revenue thresholds and deemed “doing business in” California Indirect: Upstream/downstream suppliers and farmers. | Presumed to be on track for implementation despite uncertainties (e.g., U.S. Chamber of Commerce lawsuit) |

*AB 1305 has a different scope of affected entities related to businesses involved in certain carbon market transactions and/or making certain climate-related marketing claims.

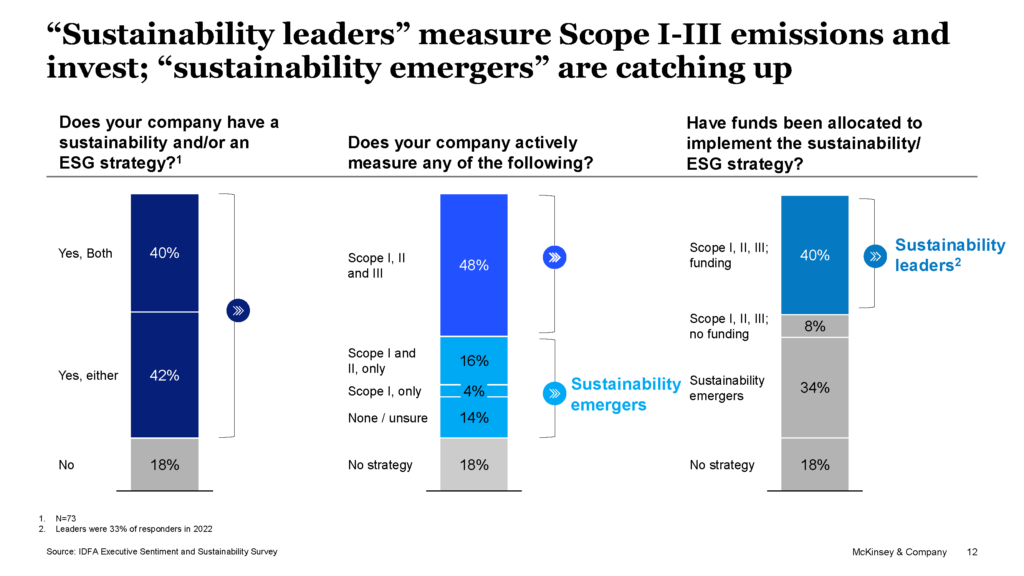

IDFA members will continue to see increased demand for GHG emissions data in the years to come from customers as well as regulatory bodies here and abroad. Notably, we believe our industry is progressing nicely in terms of remaining committed to climate change mitigating activities and GHG management. Our 2023 member ESG & Sustainability Survey, conducted in partnership with McKinsey & Co., revealed year-over-year growth in the number of members actively managing their emissions. We estimate that least two-thirds of member companies are measuring GHG emissions, and nearly half of our membership base includes scope 3 emissions in that work. The dairy industry is actively preparing for increased demand for corporate GHG disclosure. IDFA will continue bringing timely updates and expert advice to your attention as the climate-related disclosure landscape evolves. We will soon announce new programming to review the full scope of implications and details of the now-finalized SEC rule.

The finalization of the SEC climate disclosure rules presents an opportunity to remind dairy companies that GHG emissions reporting is not the only form of climate-related disclosures to be prepared for. We recommend working to ensure your company understands the details of and how to prepare for requests related to Task Force on Climate-Related Financial Disclosures (TCFD). Many resources and advisory services are available in the marketplace—we recommend beginning here. IDFA members may also access a recently recorded webinar presentation by experts from Marsh McLennan, which is available through our online Knowledge Center.

For more information about the SEC rule, we recommend this executive primer from Persefoni. Please contact me at maquino@idfa.org with any questions and comments that we can incorporate into this programming and future advocacy activities.

IDFA Staff Expert

Mike Aquino

Director, ESG