Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Blimling and Associates, Inc., a dairy research and consulting firm based in Madison, Wisconsin. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: Milk Production On The Rise, Cow Numbers at 30-year High, Food and Bev Store Sales Up, Restaurant Sales Could Rise As Dining Restrictions Begin to Ease

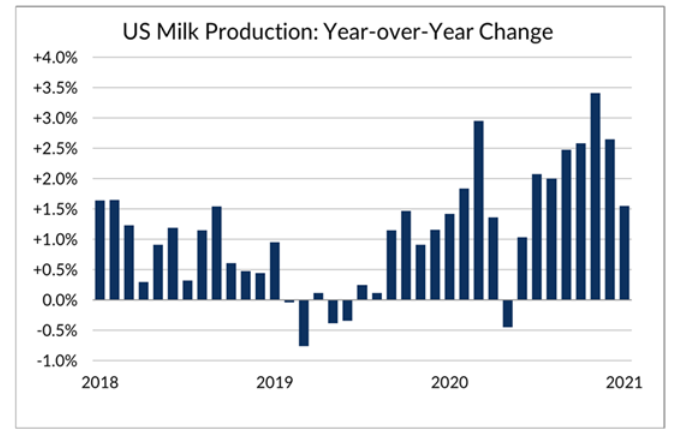

Quick Bites: Slower U.S. Output Growth

- U.S. milk production continued a growth streak in January, albeit at a slower pace than expected. Output totaled 19.2 billon pounds, up 1.6% year-over-year. That’s the smallest gain since June and well under the average increase of 2.5% over the past six months.

- Performance varied across the country. The Southwest, Midwest, Mideast and Northeast saw increased output. But the weakest performance since 2017 in the Pacific Northwest worked in the other direction.

- The January report also featured some sizable revisions to California milk production statistics. USDA downgraded California December production growth from 3.2% above prior-year levels to 0.5% below year-over-year. And those declines reportedly continued into January, with output falling 0.7%.

- While overall production growth slowed, the U.S. herd continued to expand. Cow numbers rose to a 30-year high of 9.45 million head, a gain of 8,000 animals from December. So what weighed on output? Milk per cow per day climbed just 0.6% above prior-year levels, compared to an average boost of 1.8% over the past six months.

- Even given January’s reduced rate, reports suggest there’s still plenty of milk around. USDA continues to report spot milk loads in the Upper Midwest are trading at historically steep discounts.

- Looking ahead to February, it’s likely the Southwest could see lower production numbers as winter storms – particularly in Texas – caused plenty of disruption at the farm level.

Today's Special

- With extra stimulus cash in their pockets, consumers spent heavily on their homes and hobbies last month. Data by the U.S. Census Bureau showed retail sales hit $568.2 billion dollars in January, up 5.3% from December.

- Electronics and appliances stores saw the largest month-to-month gains, rising 14.7%. Furniture and home furnishing weren’t far behind, with 12.0% growth, and sales in the sports, hobbies and books category increased 8.0% over prior-month levels.

- Food and beverage store sales continue to trend higher, increasing 2.4% month-over-month. Persons familiar with scanner data say dairy sales were riding that wave, with purchases of butter and butter blends increasing more than 10% year-over-year in January. Natural cheese sales did even better, rising 15% from the year prior.

- Data shows consumers are also starting to buy – and consume – more food outside of their homes. Though January food service sales remained 16.7% below year-prior levels, the category saw a monthly increase of 6.9%.

- More spending could be ahead as dining restrictions ease across the country. Restaurants in New York reported a spike in sales after the state rolled back restrictions on indoor dining earlier this month. Daily revenue improved to 25.1% below prior-year levels on Valentine’s Day, the best performance since late December. And a majority of those meals – nearly seven in 10 – were eaten on-premises, the most since November.