Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Blimling and Associates, Inc., a dairy research and consulting firm based in Madison, Wisconsin. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: Higher Grain Prices To Lead To Tighter Margins; Holiday Shopping Trends; and The Whey Market Minute

Quick Bites: Ho-Hum Holidays

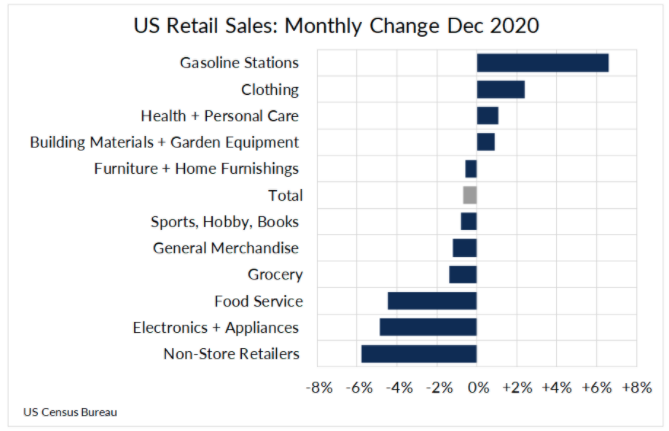

- Consumers weren’t feeling particularly festive during the holiday shopping season as analysts suggest COVID-19 restrictions limited trips to malls and restaurants. Data from the U.S. Census Bureau showed retail sales declined 0.7% month-to-month in December, below forecasts for -0.1%. That weighed on full-year 2020 sales, which inched up by a slight 0.3% over 2019.

- Food service declined 4.5% between November and December and -21.2% year-over-year as the virus and cold weather kept diners at home. Grocery purchases also lost momentum, logging a 1.4% monthly loss, though sales remained up 9.0% from prior-year levels.

- Higher fuel prices propelled gasoline station sales higher, with a 6.6% increase from November.

- Gasoline price strength had an impact on overall inflation figures. According to the U.S. Bureau of Labor Statistics, the Consumer Price Index increased 0.4% month-to-month and +1.1% compared to the year before.

- Food prices also lifted 0.4% between November and December and +1.1% from 2019. Prices climbed at both grocery stores and restaurants. Food-away-from-home inflation increased +3.9% versus November 2019, the largest year-over-year gain since May 2009. Food-at-home inflation also climbed 0.3% from November and +3.9% from the previous year.

Today's Special

- Grain prices are at the highest levels in seven or eight years following January’s bullish USDA World Agricultural Supply and Demand Estimates report. USDA dropped its forecast for 2020/21 ending corn stocks to 1.55 billion bushels, below estimates for 1.70 billion bushels. Incredibly, in May, USDA pegged ending stocks at 3.3 billion bushels. But a smaller-than-expected crop and strong export demand changed the balance sheet materially. March corn rallied in response to nearly $5.35 per bushel. That was up 35% from the beginning of November. Though the soybean figures were not quite as bullish, nearby futures followed corn higher, jumping above $14.35 per bushel, up 37% from early November. Prices have cooled some in recent days on improving weather in South America and lighter than anticipated corn export bookings, yet prices remain elevated. With the planting season still a few months away and spring/summer weather to contend with, it seems unlikely that prices will take a big step back anytime soon.

- From a dairy producer perspective, higher grain prices will lead to tighter margins in the coming months. That’s at least the math on paper. Blimling’s estimates for the USDA’s Dairy Margin Coverage program, based on current futures, point to margins near $8.20 per hundredweight for 2021. That’s down about 90 cents from the estimates at beginning of November and compares to a 2020 average of $9.60 per hundredweight. The feed cost portion of the equation is up 25% versus last year. If realized, that would be the highest feed cost going back to 2013.

- While the dairy farm margin picture is not as rosy for 2021, will it make a dramatic difference on milk production? U.S. dairy producers are already in growth mode with output up 3% year-over-year in November, aided by an expanding dairy herd. And early estimates suggest that production could increase by another 2% year-over-year in the first half. Said another way, the road to more milk in early 2021 is already mostly paved. While higher grain prices and reduced margins could impact producer morale and force some to tighten their belts, it’s unlikely to have a severe or dramatic impact on milk supply – at least in the near term.